Quick Summary

When comparing CFD vs stock trading, the key difference is ownership. With stocks, you buy and own a share of a company. With CFDs (Contracts for Difference), you don’t own anything — you simply speculate on price movements. Stocks are better for long-term investing, while CFDs offer flexibility, leverage, and the ability to trade both directions. This guide breaks down the pros, cons, risks, and ideal use cases for each so you can choose the approach that fits your goals.

Introduction

If you’re new to trading, you’ve probably heard people talk about stock trading and CFDs — but the difference between the two isn’t always clear. One involves ownership. The other is purely speculative. One is used for long-term investing. The other is used for short-term trading and flexibility.

Understanding CFDs vs stocks is important because the choice you make affects your risk, strategy, costs, and overall trading style.

This guide breaks down how CFDs work, how stock trading works, how they compare, and how to choose the one that fits your goals and personality.

What Are CFDs?

A CFD (Contract for Difference) is a financial derivative that lets you speculate on the price movement of an asset offered by a broker without owning it. You simply trade CFDs by predicting whether the price will rise or fall.

If the price moves in your favor, you profit.

If it moves against you, you lose.

Example

You think Apple shares will rise. Instead of buying the underlying asset stock, as a trader you open a CFD buy position on Apple.

-

If Apple’s share price increases, you earn the difference.

-

If it drops, you lose the difference.

No shares are owned; you are only required to speculate on the price.

Key Features of CFDs

-

No ownership of the underlying asset

-

Leverage available (trade with margin)

-

Can go long or short instantly based on the price change

-

Trade a wide variety of markets, including stocks, forex, indices, gold, oil, and crypto without owning the underlying asset.

CFDs are designed for traders looking for short-term trading opportunities and flexibility

What Is Stock Trading?

Trading stocks involves buying and owning shares of a real publicly traded company listed in stock exchanges. When you buy shares of a stock, you become a part owner or rather an investor of that company.

Example

You buy 10 shares of Tesla.

-

If Tesla grows, your shares grow in value, and you profit from price difference

-

You may receive dividends.

-

You own a piece of the company.

Stock trading is typically used for long-term investing and wealth building.

Key Features of Stocks

-

You own real shares because you are investing in stocks

-

Ideal for long-term growth

-

Eligible for dividends

-

No leverage (unless trading on margin accounts)

-

Lower risk compared to CFDs

Stocks move slower, have clearer fundamentals, and fit long-term investors better.

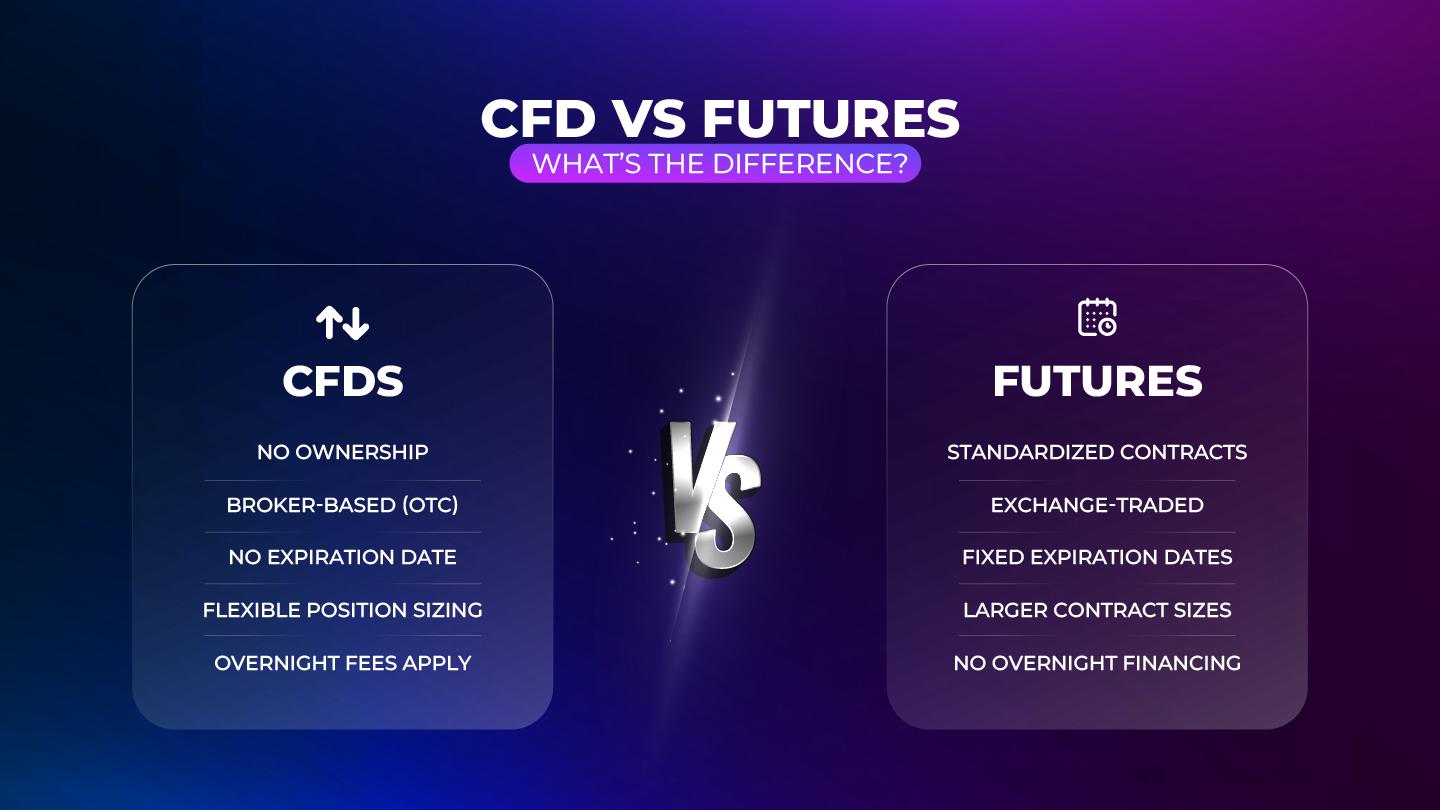

CFD vs Stock Trading: Key Differences

Below is a simple, clear breakdown of the major differences between CFDs and stocks.

1. Ownership

-

CFDs: You do not own the asset.

-

Stocks: Stocks represent ownership

Stocks offer traders long-term benefits like dividends, voting rights, and compounding growth.

2. Leverage

-

CFDs: Offer leverage — often 1:5, 1:20, or even 1:30 or more depending on the CFD broker regulation.

-

Stocks: Usually, no leverage unless you use a margin account (typically 1:2).

Leverage can magnify gains and losses

3. Trading Direction

-

CFDs: Easily trade both ways (buy or sell) on various trading platforms.

-

Stocks: Going short requires special accounts and approvals from the New York Stock Exchange.

This makes CFDs more flexible for short-term day trading.

4. Costs and Fees

-

CFDs: Usually charged via spreads, swaps (overnight fees), and sometimes commissions.

-

Stocks: Traditional stock trading typically involves commissions or zero-commission models, plus possible custody fees.

CFDs may cost more if you hold positions overnight due to swap fees.

5. Market Access

-

CFDs: Access to global markets from one platform — stocks, forex, commodities, indices, crypto trading all depending on the various CFD providers.

-

Stocks: Mostly limited to the exchange your broker supports like the New York stock exchange where you may be limited to only individual stocks from US.

CFD traders often enjoy broader market access.

6. Holding Period

-

CFDs: Best for short-term trading strategies.

-

Stocks: Stocks are generally best for long-term investing.

Because CFDs have significant trading costs such as overnight fees, which tend to depend on the price of an asset, they are not ideal for long-term positions.

7. Risk Level

-

CFDs: Higher risk due to leverage. Due to that fact, most traders lose money when trading CFDs.

-

Stocks: Share trading offers lower risk and more stability over time.

CFDs offer small accounts the capability to trade big positions — but the risk is significant.

8. Complexity

-

CFDs: More complex — leverage, margin, spreads, swaps, and most traders who use CFDs have their accounts lose money when trading.

-

Stocks: When it comes to share trading, it’s straightforward — buy, hold, or sell.

When it comes to CFDs vs stock trading, beginners often find stocks easier to understand. This is because they don’t have to speculate on the price movements.

Pros and Cons of CFD Trading

Pros

1. Trade With Leverage

Most CFDs are traded via brokers who offer significant margin that enables traders to magnify returns with smaller capital requirements.

2. Trade Any Direction

Go long or short instantly. On the other hand, stocks can only be traded within specified trading hours.

3. Access Global Markets

Trade stocks, indices, forex, crypto, and commodities from one platform and enjoy price movements without owning the underlying financial instrument asset.

4. Low Capital Needed

Small accounts can trade meaningful positions unlike stocks.

5. Fast Execution & Flexibility

CFD derivative trading is perfect for day traders and swing traders.

Cons

1. High Risk from Leverage

It’s essential for traders to understand differences between CFDs and stocks. When trading CFDs small movements can wipe out large positions.

2. Overnight Fees

Share CFDs are not ideal for long-term holding.

3. Complexity

Margin, swaps, and leverage require education to ensure that your trading decisions align with your overall trading goals.

4. No Ownership

You don’t get dividends or long-term growth. All you can do is speculate on its price movements and hope to potentially profit from price.

Pros and Cons of Stock Trading

Pros

1. Ownership of a Real Asset

Your shares represent real value.

2. Lower Risk

No leverage unless you use margin.

3. Dividends

One of the key differences between CFDs and stock trading is that passive income can be generated from certain stocks.

4. Long-Term Growth

Historically, stocks generally rise over time.

5. Simple and Transparent

Buy → Hold → Benefit from growth.

Cons

1. Higher Capital Requirement

You need more money to buy a stock.

2. No Easy Shorting

Short selling requires approvals or margin accounts from the New York exchange or London stock exchange depending on the asset you wish to short.

3. Limited Market Access

Stock exchanges like the London exchange determine which markets you access.

4. Slower Returns

Stocks are traded globally but, they move slower than leveraged CFD positions.

CFDs or Stocks: Which Is Better for You?

The answer depends on your goals, personality, capital, and trading style.

Here’s a clean breakdown to help you choose.

Choose CFDs if you:

-

Want to trade short-term

-

Want flexibility to go long or short

-

Have a small account

-

Prefer fast-moving markets

-

Are comfortable managing leverage

-

Can commit to disciplined risk management since trading involves in losses most of the time.

CFDs fit traders who want fast execution and opportunities across many markets, but CFD trading typically comes with high risk.

Choose Stocks if you:

-

Want long-term wealth building

-

Prefer lower risk

-

Don’t want to worry about overnight fees

-

Like the idea of owning real companies

-

Value dividends

-

Have a medium-to-long-term investment horizon

Stocks suit investors with patience who want stability over speed.

Side-by-Side Comparison Table

|

Feature |

CFDs |

Stocks |

|

Ownership |

No ownership |

Own real company shares |

|

Leverage |

High leverage |

Low/no leverage |

|

Direction |

Long & short easily |

Long, shorting limited |

|

Market Access |

Global, multiple asset classes |

Limited to stock exchanges |

|

Costs |

Spread + swaps |

Commissions/custody fees |

|

Risk |

High |

Moderate to low |

|

Best For |

Short-term trading |

Long-term investing |

Which Is More Beginner-Friendly?

Stocks are typically more beginner-friendly because they’re simple, stable, and involve no leverage.

CFDs can also work for beginners — but only if they:

-

learn risk management

-

avoid high leverage

-

understand margin rules

Without discipline, CFD trading becomes dangerous quickly.

Frequently Asked Questions (FAQs)

1. Are CFDs riskier than stocks?

Yes. CFDs use leverage, which magnifies both gains and losses. Stocks are less risky because you’re trading without leverage in most cases.

2. Can I trade stocks as CFDs?

Yes. Many brokers let you trade CFDs that mirror real stocks like Apple or Tesla, without owning the shares.

3. Which is better for small accounts?

CFDs. You can trade with small capital because of leverage, but you must be careful with risk.

4. Do CFDs pay dividends?

You don’t receive real dividends, but some CFD brokers adjust your balance to reflect dividend payouts or deductions.

5. Can I hold CFDs long term?

It’s possible but not recommended due to overnight swap fees. Stocks are better for long-term holding.

Experience the flexibility of CFD trading with 4Proptrader’s funded accounts. Trade global markets without risking your own money.

Final Thoughts

When comparing CFD and stock trading, the best choice depends on your goals.

Choose CFDs if you want flexibility, short-term trading opportunities, and access to global markets, but only if you understand leverage and risk management.

Choose stocks if you want long-term growth, stability, and real ownership.

Both have their place in the trading world. What matters most is choosing the one that aligns with your personality, risk tolerance, and financial goals.

.jpg)