CFDs are broker-based contracts that track price movements with flexible sizing and no expiry, while futures are exchange-traded contracts with fixed sizes and expiration dates used to lock in a future price.

Quick Summary

The difference between CFDs and futures lies in how each trading instrument is structured, priced, and used in real-world markets. CFDs—short for contract for difference—and future contracts both allow traders to speculate on price movement without owning the underlying asset, but they operate in very different ways.

With cfd trading, a trader agrees to exchange the difference between the buy and sell price of an asset with a broker, making CFDs a flexible option for short-term strategies such as day trading. In contrast, future trading involves standardized contracts traded on a regulated futures market, where participants agree to buy or sell an asset at a set price on a future date.

This guide explores CFDs vs futures, breaking down how CFDs and futures work, their costs, leverage, margin requirements, and use cases. By understanding the key differences between CFDs and futures, you’ll be better equipped to make informed trading decisions that align with your trading goals.

Introduction

If you’re exploring leveraged markets, you’ve likely come across cfds vs futures trading while researching different ways to trade global assets. Both cfds and futures enable speculation on the future price of markets such as forex, commodity, stock, and index instruments—without taking ownership of the actual asset.

However, while they may appear similar on the surface, the difference between cfds and futures becomes clear once you examine how each product functions behind the scenes. Whether you’re trading cfd products through a trading platform or choosing to trade futures on an exchange, the mechanics, risks, and costs vary significantly.

Understanding these distinctions matters because they directly affect how you’re trading, including:

- how positions are opened and closed

- how contract size impacts exposure

- how leverage amplifies gains and losses

- how pricing reflects the price of an underlying market

By clearly comparing futures vs CFDs, this guide helps traders understand which approach fits their experience level, capital, and overall strategy, whether that’s forex trading, trade commodities, or index speculation.

Before diving deeper, here’s a quick side-by-side look at the core differences between CFDs and futures:

- CFDs are broker-based contracts with no expiry and flexible position sizing, ideal for short-term and retail trading.

- Futures are exchange-traded contracts with fixed sizes and expiration dates, commonly used by professional and institutional traders.

- CFDs include spreads and overnight fees, while futures typically involve commissions but no financing costs.

- CFDs offer higher flexibility and accessibility, whereas futures provide greater transparency and centralized liquidity.

What Are CFDs?

A CFD—short for contract for difference, is a leveraged trading instrument that allows traders to speculate on the price of a financial market without owning the underlying asset. Instead of purchasing the asset itself, you enter a CFD contract with a broker, agreeing to profit or loss based on the price difference between entry and exit.

When trading cfd products, you’re not buying shares, currencies, or commodities directly. Rather, cfds work by tracking the price of an underlying market such as a stock, index, commodity, or forex pair. If the market moves in your favor, you profit; if it moves against you, you incur a loss.

Because CFDs are designed to mirror real market prices, they allow traders to buy or sell based on expected price movement, whether markets are rising or falling. This makes cfd trading especially popular among cfd traders focused on short-term strategies like day trading and intraday speculation.

In simple terms, CFDs allow traders to speculate on market direction without ownership, delivery, or expiration—offering a streamlined way to access global markets.

Key Characteristics of CFDs

CFDs are designed for flexibility and accessibility, which is why they’re widely used by retail traders. Below are the defining features that shape how CFDS offer exposure to global markets:

- No ownership of the underlying asset

When using CFDs, you never own the actual asset, only the contract reflecting its price movement. - Traded over-the-counter via a broker

CFDs are offered by a CFD broker through a proprietary trading platform, rather than a centralized exchange. - Leverage-based trading

CFDs use leverage, allowing traders to control larger positions with less capital. While this enhances opportunity, it also increases risk. - Flexible position sizing

Unlike standardized contracts, CFDs allow variable contract size, making them suitable for smaller accounts and precise risk control. - Ability to go long or short easily

Traders can speculate on rising or falling prices without restrictions, simply by choosing to buy or sell. - No fixed expiration date

CFDs don’t expire, enabling flexible trading across multiple trading hours, subject to overnight costs. - Costs built into pricing

Costs typically include the difference between the buy and sell price (spread), and potential overnight fees during a trading day.

Many brokers also provide a cfd demo or trading demo, allowing users to practice in simulated conditions before moving into live trading.

Overall, CFDs offer flexibility, accessibility, and efficiency, making them a popular choice for traders focused on short-term opportunities and adaptable strategies.

What Are Futures?

Futures are standardized future contracts that obligate traders to buy or sell an asset at a set price on a specific date in the future. Unlike CFDs, futures are traded on a centralized futures market, where pricing, execution, and settlement are governed by the exchange rather than a broker.

When engaging in future trading, participants are speculating on the future price of an asset such as a commodity, index, stock, or currency pair. Popular examples include oil futures, commodity futures, and currency futures, all of which reflect expectations about the market’s direction at a later date.

Although futures involve an agreement to transact in the future, most traders do not intend to take delivery of the asset. Instead, they trade futures to profit from changes in price movement, closing positions before expiration. This makes futures suitable not only for speculation, but also for hedging purposes, where participants may use futures or futures to hedge exposure to market risk.

Because futures are exchange-traded and highly regulated, futures provide transparency, deep liquidity, and consistent pricing, features that appeal to professional and institutional traders.

Key Characteristics of Futures

Futures contracts are designed around structure and standardization, offering a very different experience compared to cfd and futures trading through brokers. The defining characteristics of futures include:

- Standardized contracts

Futures operate using standard futures, meaning contract terms—such as contract size, tick value, and expiration—are fixed by the exchange. - Exchange-traded environment

All trades occur within a centralized futures market, ensuring transparent pricing and fair access for participants. - Defined margin requirements

Futures require traders to meet exchange-set margin requirements, calculated per contract, rather than flexible leverage ratios. - Fixed expiration dates

Every futures contract has a defined expiry, requiring traders to close, roll over, or settle positions before the end of the trading day cycle. - No overnight financing fees

Unlike CFDs, futures positions do not incur swap or overnight charges, which can be beneficial for longer holding periods. - Clear pricing mechanics

Futures prices reflect the market’s consensus future price of an asset, factoring in supply, demand, and time until expiration.

Because of their structure, futures trading offers consistency and reliability. Futures offer deep liquidity, particularly in major markets, and are often preferred by experienced traders who value transparency and scalability.

Overall, futures trading offers a disciplined environment suited to traders who understand contract specifications and are comfortable operating within predefined rules.

Difference Between CFD and Futures: Core Comparison

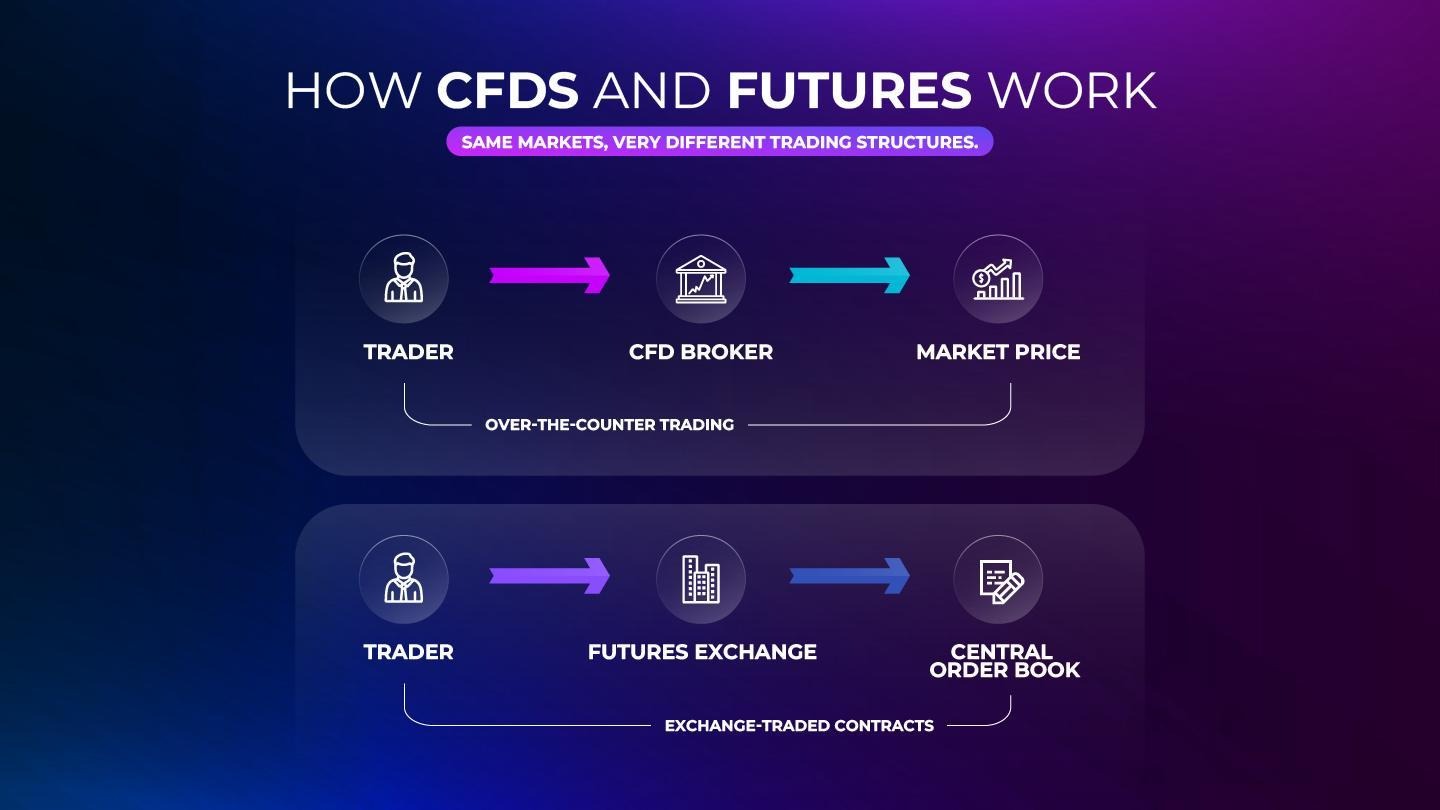

1. Trading Structure

- CFDs: Broker-based, OTC instruments

- Futures: Exchange-traded contracts

With CFDs, your broker sets pricing and execution. With futures, prices are determined by the exchange and market participants.

2. Ownership and Settlement

- CFDs: No ownership, cash-settled only

- Futures: No ownership either, but contracts may settle physically or in cash

Most futures traders close positions before expiry to avoid delivery.

3. Expiration Dates

- CFDs: No expiry — positions can be held indefinitely (subject to fees)

- Futures: Fixed expiration dates

Futures traders must roll contracts forward if they want continued exposure.

4. Leverage and Margin

- CFDs: Flexible leverage set by broker and regulation

- Futures: Exchange-defined margin requirements

If you choose to trade CFDs be advised that the leverage is often higher, which increases risk for retail traders. Futures margins are standardized and can still be substantial.

5. Trading Costs

- CFDs:

- Spreads

- Overnight (swap) fees

- Possible commissions

- Spreads

- Futures:

- Commissions

- Exchange fees

- No overnight financing fees

- Commissions

CFDs are generally cheaper for short-term trades, while futures can be more cost-effective for active intraday traders.

6. Market Access

- CFDs: Wide access to stocks, indices, forex, commodities, crypto

- Futures: More limited, but very deep liquidity in major contracts

CFDs offer convenience. Futures offer depth and institutional-grade markets.

7. Position Sizing and Contract Size

- CFDs: Highly flexible position sizing

- Futures: Fixed contract sizes (though micro futures exist)

CFDs are often easier for beginners because you can trade very small sizes.

8. Liquidity and Transparency

- CFDs: Liquidity depends on broker

- Futures: Centralized order book and transparent volume

Futures markets provide clearer insight into market depth and participation.

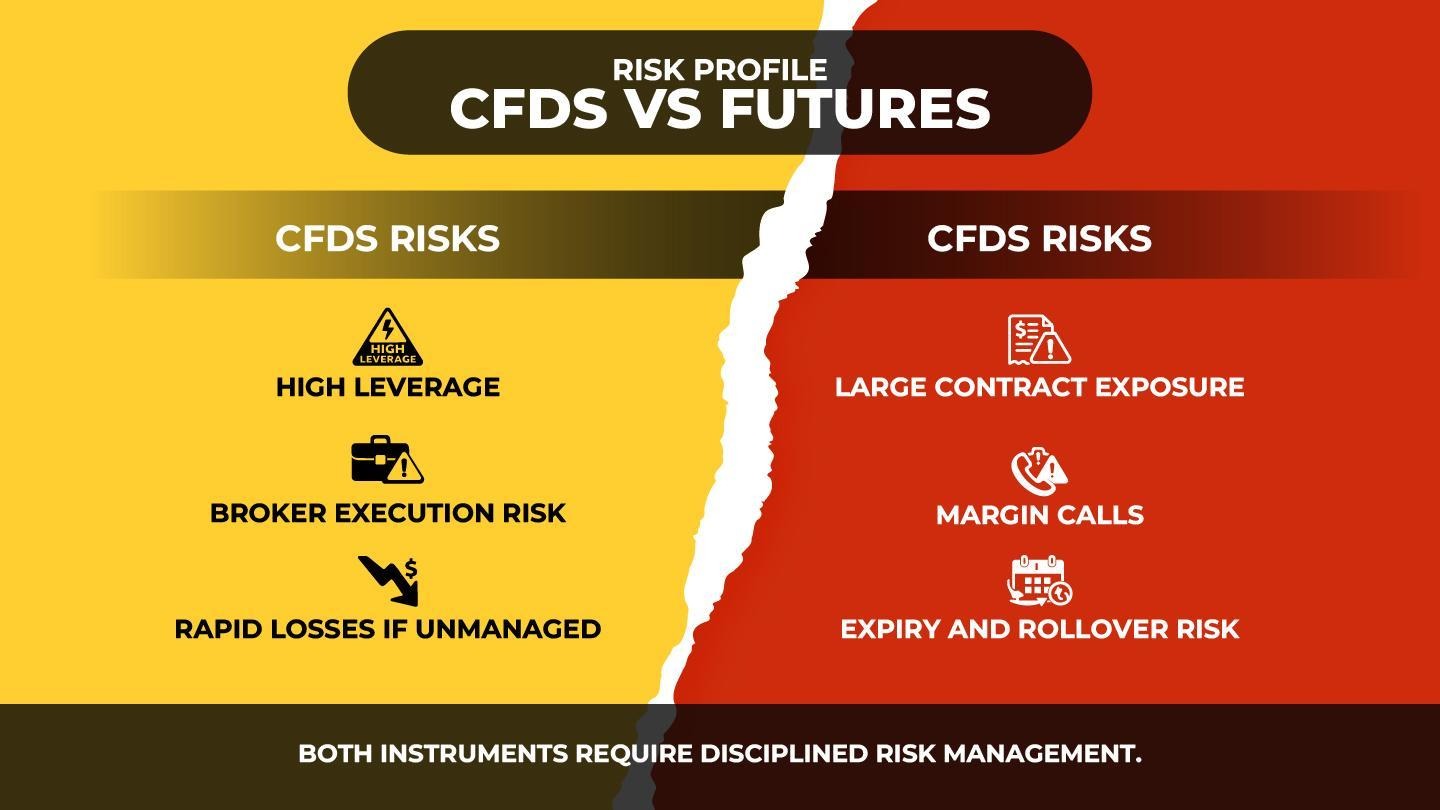

Risk Comparison: CFDs vs Futures

CFD Risks

- High leverage magnifies losses

- Broker execution risk

- Overnight fees can erode profits

- OTC structure means less transparency

CFDs require strict risk management to avoid rapid drawdowns.

Futures Risks

- Large contract sizes can amplify losses

- Margin calls during volatile periods

- Expiration and rollover complexity

- Steep learning curve

Futures demand precision, discipline, and capital adequacy.

Who Uses CFDs?

CFDs are typically used by:

- Retail traders

- Short-term traders (day/swing)

- Traders with smaller accounts

- Traders who want multi-asset access

- Traders who value flexibility

CFDs suit those who prioritize convenience and versatility.

Who Uses Futures?

Futures are commonly used by:

- Professional traders

- Institutional participants

- Hedgers (farmers, energy firms, funds)

- High-volume traders

- Traders seeking deep liquidity

Futures favor traders who are comfortable with structure and complexity.

Regulation Differences

- CFDs: Heavily regulated in some regions, restricted or banned in others

- Futures: Traded on regulated exchanges globally

CFDs are often subject to leverage caps and marketing restrictions, while futures operate under exchange rules.

Example: CFD vs Futures Trading

CFD Example

- Trade S&P 500 CFD

- Small margin required

- No expiry

- Pay overnight fees if held

Futures Example

- Trade E-mini S&P 500 futures

- Larger margin requirement

- Fixed expiry

- No overnight financing

Both track the same market but behave very differently.

Which Is Better: CFD vs Futures?

There’s no universal “better” choice — it depends on your goals.

CFDs May Be Better If You:

- Are a beginner or intermediate trader

- Want flexible position sizing

- Prefer short-term trading

- Have limited capital

- Want access to many markets

Futures May Be Better If You:

- Trade actively and frequently

- Want deep liquidity and transparency

- Can handle larger contract sizes

- Prefer exchange-traded instruments

- Have experience with margin trading

Key Differences at a Glance

| Feature | CFDs | Futures |

|---|---|---|

| Trading Venue | OTC via broker | Exchange-traded |

| Expiration | None | Fixed dates |

| Position Size | Flexible | Fixed contracts |

| Costs | Spread + swaps | Commission |

| Leverage | Broker-defined | Exchange-defined |

| Transparency | Lower | High |

| Best For | Retail traders | Professional traders |

Frequently Asked Questions (FAQs)

Is CFD trading the same as futures trading?

No. While both are derivatives, they differ in structure, costs, regulation, and risk.

Are futures riskier than CFDs?

Both are risky. CFDs often have higher leverage, while futures involve larger contract exposure.

Can beginners trade futures?

Yes, but the learning curve is steeper. Many beginners start with CFDs due to flexibility.

Do CFDs or futures cost more?

It depends on the trading style. CFDs cost more for long-term holding; futures may cost more per trade but lack overnight fees.

Can I trade the same markets with CFDs and futures?

Often yes: indices, commodities, and currencies are available in both markets.

Trade both CFDs and futures with 4Proptrader's capital — apply for a funded account and start your professional trading journey today.

Final Thoughts

Understanding the difference between CFD and futures is essential before choosing which instrument to trade. CFDs offer flexibility, ease of access, and small position sizing, making them popular with retail traders. Futures provide transparency, liquidity, and standardized contracts favored by professionals.

Both instruments can be powerful — and dangerous — if misused.

The best choice is the one that matches your:

- experience level

- risk tolerance

- capital

- trading goals

Choose wisely, manage risk carefully, and trade with intention, not impulse.

.jpg)