Quick Summary

Risk management means protecting your capital by controlling how much you risk per trade, managing exposure, avoiding catastrophic losses, and maintaining long-term discipline. It’s the foundation of successful and rational trading; not profit targets, not technical analysis, not entries. This guide covers the essential risk management rules every trader must master to survive and succeed in the markets.

Introduction

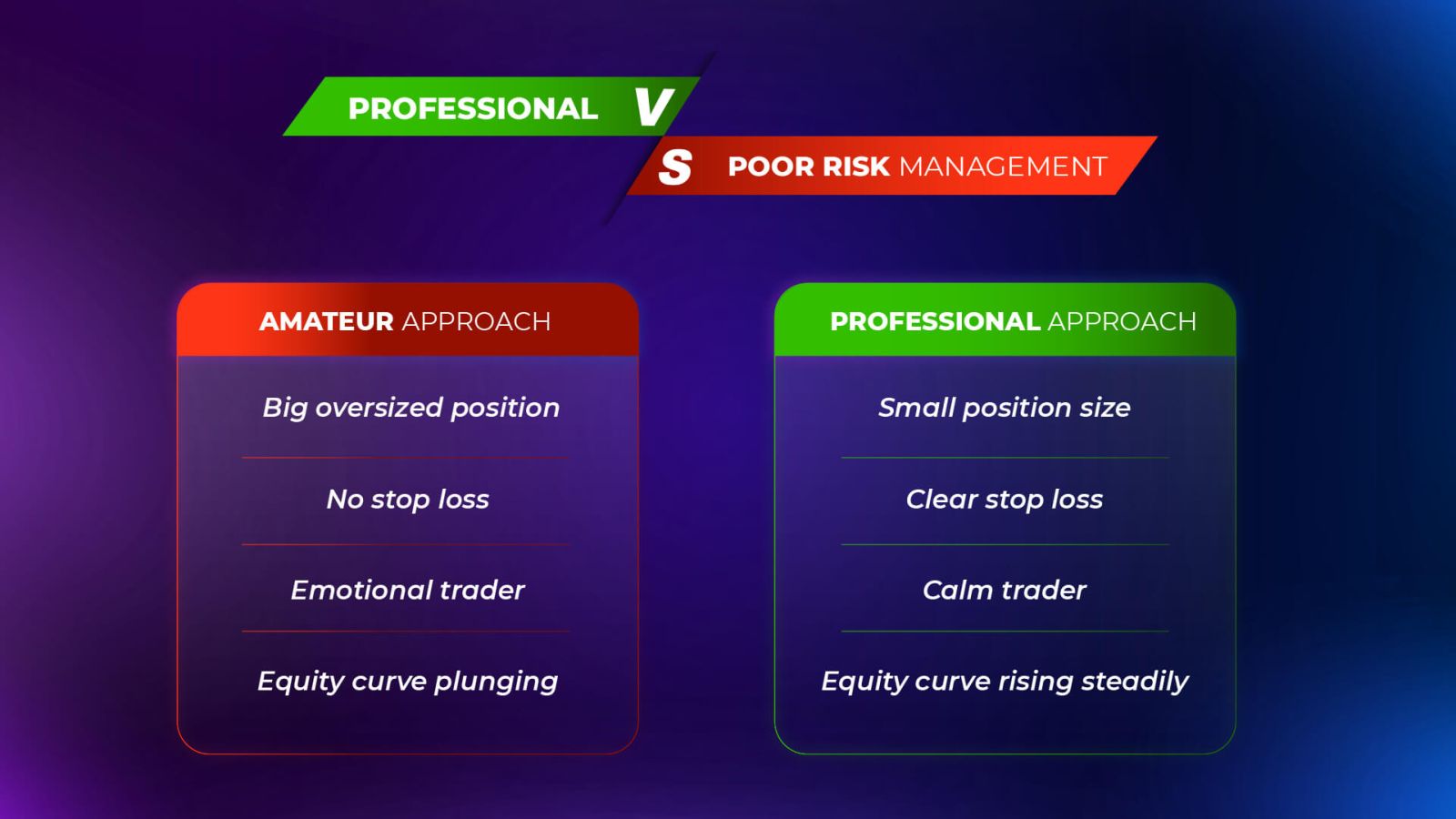

If you ask any consistently profitable trader what separates winners from losers, you’ll hear the same answer: risk management. Not strategy. Not indicators. Not chart patterns. It’s how you manage risk that determines how long you stay in the game, and whether your capital grows or disappears.

In fact, many traders lose not because their trading strategy is bad, but because their risk is unmanaged.

Without a proper risk management, traders may use too much leverage, execute trades with oversized positions, and engage in revenge trading, which spirals down to emotional decisions that eventually lead to them blowing up their trading accounts. That’s why risk management is an essential tool that should be in every trader’s arsenal.

This guide breaks down practical, real-world techniques to help you master proper risk management in trading like a pro, so you can keep your capital safe and give your strategy a real chance to work.

What Is Risk Management in Trading?

Risk management in trading refers to the set of rules, habits, and techniques that limit losses, control exposure, and protect your trading account from severe drawdowns.

Good risk management ensures that:

-

no single trade can destroy your account

-

your losses stay small and predictable

-

your wins have room to grow

-

your emotions stay under control

-

you preserve capital and longevity

Trading is not about being right every time. It’s about surviving long enough for your edge to play out.

Why Risk Management Matters More Than Strategy

Most day traders obsess over finding the “perfect strategy.” But pros know this truth:

👉 Strategy determines how much you can win.

Risk management strategies determine whether you win at all.

Here’s why risk management is essential:

1. Protects Your Capital

You can’t trade if your account is blown. Risk controls prevent catastrophic losses.

2. Prevents Emotional Decisions

Clear rules reduce panic, revenge trading, and impulsive behaviour.

3. Improves Consistency

Even an average strategy becomes powerful when paired with disciplined and well curated risk management plan.

4. Creates Long-Term Stability

Small, controlled losses keep your equity curve stable, which is crucial for professional traders.

Core Principles of Risk Management in Trading

1. Never Risk More Than 1–2% Per Trade

This is the golden rule.

If your account is $10,000:

-

1% risk = $100

-

2% risk = $200

This ensures that even a losing streak won’t destroy your account.

Example:

$500 risk per trade on a $10,000 account?

Just 5 losing trades could wipe out 25% of your trading account balance.

Risking $100 in a single trade?

You can survive drawdowns and recover.

Small risk = big longevity.

2. Use Stop Loss Orders — Every Time

A stop-loss is your safety net. It prevents small losses from turning into disasters.

A successful trader knows:

-

where they enter,

-

where they exit in profit,

-

and where they exit in loss

before clicking “buy” or “sell.”

If you don’t have a stop-loss in every trade, you’re gambling, not trading.

3. Position Sizing Matters More Than Entries

Most traders fail because their position size is too large for their account and strategy.

You size positions based on:

-

account size

-

stop-loss distance

-

risk percentage

Not based on “how confident you feel.”

Use a position size calculator if needed. It removes guesswork.

4. Avoid Over-Leveraging

Leverage is a double-edged sword.

-

It amplifies trading risk.

-

It destroys accounts when used recklessly.

If you’re trading with high leverage and no risk plan, one sudden market spike due to volatility can liquidate your position instantly.

Pros use leverage carefully, not emotionally.

5. Know Your Maximum Daily Loss Limit

You should set a personal daily loss limit even if your broker or prop firm does not require it.

A good rule:

👉 Stop day trading if you lose 3–5% of your account.

Why?

Because after big losses, emotions take over:

-

frustration

-

fear

-

revenge trading

These lead to bad trading decisions. Stopping protects you from yourself.

6. Understand Drawdown and Protect Equity

Drawdown is the decline in account balance from its peak.

Large drawdowns:

-

damage confidence

-

take a long time to recover

-

reduce your ability to compound gains

Example:

Lose 50% of your account?

You need a 100% gain just to break even.

Risk management prevents deep drawdowns, so recovery is easier and faster.

7. Focus on Risk-to-Reward Ratio

A good risk-to-reward (R: R) ratio is the backbone of profitable trading.

Common standards:

-

1:2 → risk $100 to make $200

-

1:3 → risk $100 to make $300

With a solid R:R ratio:

-

you can be wrong more than half the time and still be profitable

-

your strategy becomes more resilient

-

your wins outrun your losses

This is where many traders go from break-even to profitable as a higher percentage of their trades hit take-profit.

Common Risk Management Mistakes Traders Make

1. Risking Too Much on a Single Trade

This is the #1 reason traders blow accounts.

Risk becomes emotional, not mathematical.

2. Moving Stops Out of Fear or Hope

If you keep shifting your stop further away:

-

you’re increasing risk

-

you’re breaking your rules

-

you’re letting emotions control you

Always respect your original stop and stick to a proper risk management strategy.

3. Adding to Losing Positions

Averaging down is one of the fastest ways to wipe out trading capital.

Pros add to winning positions, not losing ones.

4. Revenge Trading After a Loss

You have a losing trade of $200 and try to make it back instantly.

Then lose another $200.

Then $500.

This spiral destroys accounts.

The cure?

Walk away. Stick to your trading plan and learn to manage your risk.

5. Trading Without a Plan

If you can’t answer:

-

How much am I risking?

-

Where am I exiting?

-

Why am I entering this trade?

…you’re not managing risk.

You’re gambling. Successful trading is all about knowing the risk involved before executing a trade.

Best Risk Management Techniques

1. Scaling In and Scaling Out

Scaling in means entering positions in smaller parts instead of all at once.

Scaling out means taking partial profits along the way.

This helps:

-

manage risk at entry

-

lock in profits gradually

-

improve psychological control

2. Using ATR (Average True Range) for Stop Placement

Instead of guessing stop positions, advanced traders use volatility-based stops.

ATR measures how much an asset typically moves.

Higher volatility → wider stop.

Lower volatility → tighter stop.

This adapts risk to market conditions.

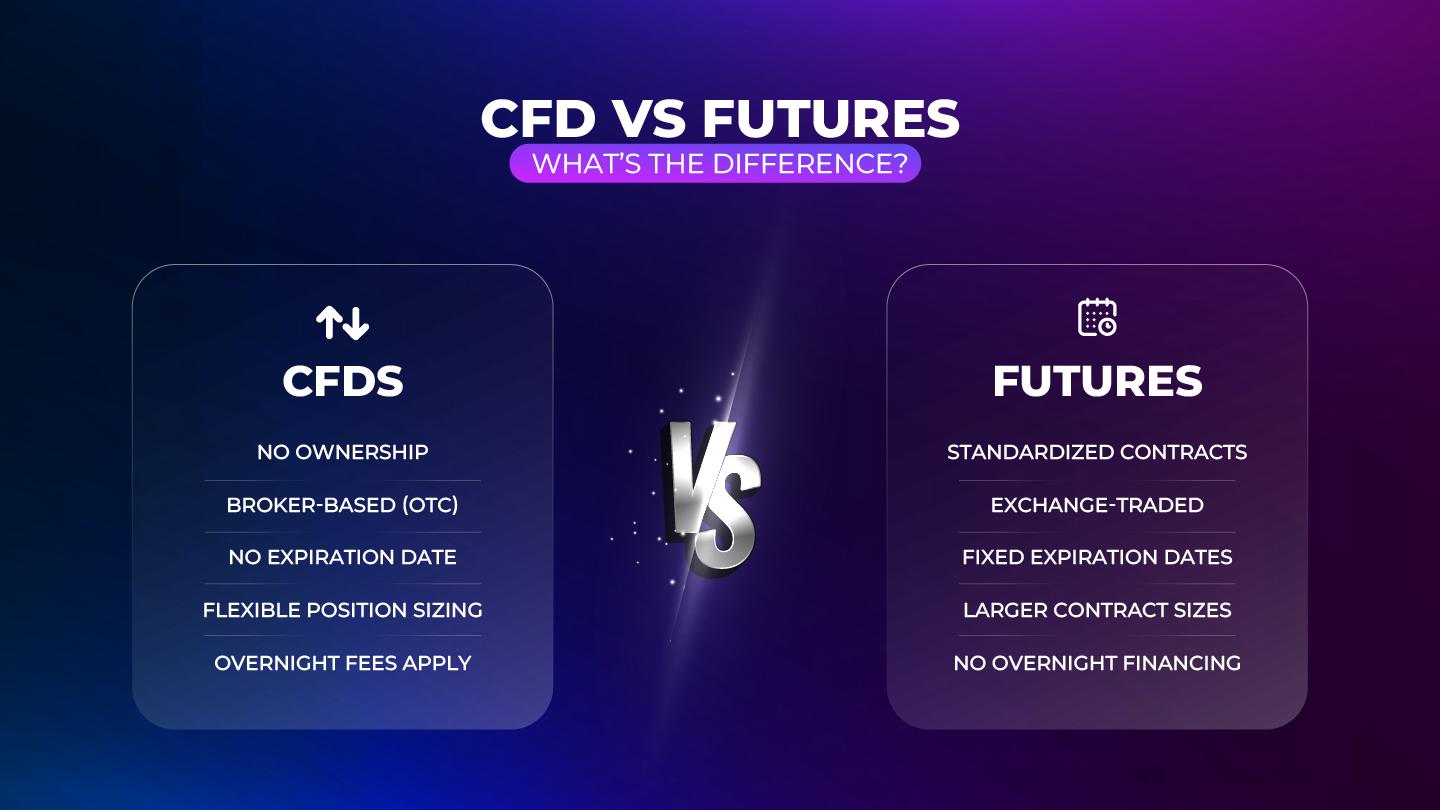

3. Hedging Positions

Some traders hedge by taking opposite positions:

-

in correlated assets

-

or in options

-

or futures

This reduces potential losses and protects against sudden market shocks.

4. Equity Curve Control

This method limits trading size when your equity drops.

Example:

-

If equity drops 10%, reduce position size by 50%.

It preserves capital during drawdowns and helps you survive losing streaks in the financial markets.

The Psychological Side of Risk Management

Risk management isn’t only numbers and rules, it’s psychology.

The best traders manage:

-

fear

-

greed

-

hesitation

-

overconfidence

-

frustration

They understand that their brain will try to sabotage them, and their risk management rules protect them.

Great risk management creates:

-

calm decision-making

-

predictable behaviour

-

consistent performance

-

emotional stability

Most traders don’t lose because of charts.

They lose money because of emotions.

That’s why risk management techniques are the cure.

Building Your Personal Risk Management Plan

Here’s a simple structure you can follow:

1. Define Your Max Risk Per Trade (1–2%)

This is the cornerstone of your plan.

2. Set a Daily and Weekly Max Loss Limit

Example:

-

Daily max loss: 3%

-

Weekly max loss: 6%

If you hit either, cut your losses and stop trading.

3. Pick Your Risk-to-Reward Minimum

Minimum 1:2 risk reward is ideal.

4. Decide Your Maximum Open Positions

Avoid overexposure by limiting open positions.

5. Use a Trading Journal

Record:

-

entries

-

exits

-

emotions

-

mistakes

-

improvements

This keeps you accountable.

Frequently Asked Questions (FAQs)

1. What is risk management in trading?

Risk management in trading is the practice of controlling how much capital you put at risk on each trade and protecting your account from large, damaging losses. It includes using stop-losses, managing position size, controlling leverage, and limiting daily or weekly loss amounts.

2. Why is risk management more important than strategy?

Because even the best strategy fails if your losses are too big. Well-structured risk management keeps you in the game long enough for your strategy to work. Without risk mitigation, a few bad trades can wipe out your entire account.

3. How much should I risk per trade?

Most professional traders risk 1–2% of their account on each trade. This ensures many traders can survive losing streaks without blowing their accounts.

4. Do I need a stop-loss on every trade?

Yes. A stop-loss order is essential for limiting damage when the market moves against you. Traders who trade without stop losses end up losing all of their money.

5. What’s a good risk and reward ratio?

The rule of thumb is 1:2. This means you risk $100 to make $200. With a strong risk-to-reward ratio, you can be wrong more often and still end up profitable.

6. How do I avoid over-leveraging?

The best traders keep position sizes small, avoiding using all available margin, and base their leverage on risk percentage — not on emotional confidence or “gut feeling.”

7. What causes traders to blow accounts?

The main causes include:

-

risking too much per trade

-

revenge trading after losses

-

adding to losing positions

-

trading without a stop-loss

-

over-leveraging. This can amplify potential gains, but you also run the risk of losing your entire capital.

-

emotional decision-making

All of these are signs of poor risk management.

8. How do I control emotions while trading?

Have predefined rules, take breaks after losses, reduce position sizes during stress, and journal your thoughts. In the world of trading, structure and discipline reduce emotional volatility.

9. Should beginners focus more on learning strategy or risk management?

Beginners should focus on risk management first. A mediocre strategy with excellent risk discipline outperforms a great strategy with poor risk control every time.

10. Can I become profitable just by managing risk well?

Yes, strong risk management makes almost any reasonable strategy viable. Traders who control their losses often find consistency long before they perfect their entries.

Final Thoughts

Mastering risk management in trading is the difference between being a gambler and being a professional trader. Trading success isn’t about finding the perfect strategy, it’s about protecting your capital, understanding risk, staying disciplined, and making sure your losses stay small and controlled.

If you treat risk management as your #1 priority, everything else becomes easier:

-

your confidence improves

-

your decision-making sharpens

-

your winning trades matter

-

your account grows steadily

Remember:

Anyone can take a trade.

Only disciplined traders survive.

Reduce risk. Protect your capital. Trade like a pro.

Want to practice professional risk management with real funding? Join 4Proptrader’s funded trader program and grow your skills safely.