Quick Summary

Trading psychology is often what separates a funded trader from a consistently successful trader. Even strong technical analysis can fail when greed takes over, when fear and greed distort the decision-making process, or when your mental state shifts after a loss.

In funded trading—where rules, drawdowns, and volatility increase pressure—solid risk management and a clear trading plan help prevent emotionally driven mistakes like overtrading and breaking discipline. In simple terms, trading psychology refers to how emotions, habits, and mindset shape execution under pressure, and why staying calm is essential for long-term trading success.

Introduction

Many traders believe that passing a funded trading challenge is purely about strategy or indicators. In reality, long-term trading success depends far more on the mental state behind each decision than on any single setup. Even the best systems fail when emotions such as fear or greed begin to influence execution.

Funded trading places traders in a high-pressure environment where volatility, strict rules, and performance targets amplify psychological stress. Without proper self-awareness, a trader may act impulsive, abandon their trading plan, or make emotionally driven investment decisions that damage their trading account.

This is where trading psychology is understanding how mindset affects behavior. Trading psychology refers to the emotional component behind the decision-making process, including how bias, fear of missing out, and greed or fear can cause traders to act irrationally. These psychological forces often lead traders to follow the crowd, ignore risk management, or repeat the same pitfall patterns that undermine consistency.

What Is Trading Psychology?

Trading psychology refers to the emotional component and mental framework that shapes how a trader approaches the markets. At its core, psychology refers to the emotional and cognitive factors that influence how traders think, feel, and act when making trading decisions under pressure.

In practical terms, trading psychology is understanding how emotions such as fear and greed, personal bias, and internal mental patterns affect the decision-making process. These forces can cause traders to act emotionally driven, abandon rational decisions, or act irrationally during moments of stress or uncertainty.

A critical part of trading psychology is recognizing how cognitive biases and mental shortcuts influence behavior. For example, fomo (the fear of missing out) can push traders to chase entries, while status quo bias can cause them to hold losing positions. In volatile markets, traders may also follow the crowd, react to the actions of others, or engage in panic selling rather than relying on logic.

Because trading involves real risk and uncertainty, emotions such as fear or greed or fear can overpower rationality and judgment, especially during periods of high volatility. Without strong self-awareness, these reactions can lead to impulsive behavior, damage trading performance, and negatively impact a trading account.

Ultimately, for traders, mastering trading psychology means understanding how emotions, thoughts, and behavioral tendencies influence their trading and learning how to stay grounded in risk management, structure, and discipline. This mental skillset is a fundamental part of trading and a key driver of long-term trading success.

Why Trading Psychology Is Even More Important for Funded Traders

Funded trading environments amplify psychological pressure far more than day trading in a personal account. When traders are trading securities under strict rules, emotions carry heavier consequences, making mindset one of the most important aspects of trading at a professional level.

1. Strict Rules Create Mental Pressure

Funded traders operate within clearly defined boundaries, where daily loss limits and drawdown rules leave little room for emotional error. This environment exposes underlying mental patterns, especially when traders feel an excessive desire to recover losses quickly.

Under pressure, traders may abandon their natural trading style, override fundamental analysis, or ignore structure altogether. This is where psychology becomes critical—psychology refers to the emotional response triggered when rules restrict freedom. Understanding this pressure is the first step in understanding how to control impulsive reactions before they turn into violations.

2. Fear of Losing the Account

Fear intensifies when traders realize one mistake can end their evaluation or funded status. This fear often distorts judgment, leading to hesitation, premature exits, or avoidance of valid setups.

Here, common psychological reactions emerge. Traders may believe that biases can help protect them, when in reality unchecked fear often causes over-cautious decisions. As Mark Douglas famously emphasized, consistency comes from accepting uncertainty—not trying to eliminate it. Learning how psychology really works under fear is essential for becoming a successful trader in a funded environment.

3. Performance-Based Stress

Funded traders often feel pressure to perform, especially after a losing day. This stress can lead to behavior changes that weren’t part of the original plan, including forcing trades or deviating from analysis.

Performance stress also increases the likelihood of emotional spirals, where a trader moves from one loss into revenge trading without pause. Without reflection, these patterns repeat. This is why keeping a trading journal is so valuable—it reveals how emotions influence decisions and highlights which psychological responses need correction.

Ultimately, performance pressure exposes whether a trader has truly mastered the mental side of trading. Those who recognize and manage these pressures build resilience, consistency, and long-term stability.

Trading Psychology: Retail Traders vs Funded Traders

While both retail and funded traders face emotional challenges, the psychological pressure is fundamentally different. Understanding this distinction is critical for traders transitioning into funded environments.

Retail Trader Psychology

Retail traders typically trade their own capital with fewer external restrictions. This often creates a more relaxed psychological environment, but also encourages bad habits.

Common psychological traits among retail traders include:

- greater tolerance for emotional decision-making

- moving stop losses or ignoring exits

- chasing losses without immediate consequences

- focusing heavily on profit rather than consistency

Because there are no strict rules enforcing discipline, many retail traders unknowingly reinforce poor psychological behaviors that limit long-term growth.

Funded Trader Psychology

Funded traders operate under explicit rules, drawdown limits, and performance conditions. This structure significantly increases psychological pressure — but also rewards discipline.

Funded trading psychology requires:

- emotional control under strict risk constraints

- consistency over short-term profits

- acceptance that one mistake can end an account

- disciplined execution even during losing streaks

Unlike retail trading, emotional mistakes in funded trading have immediate and permanent consequences, making psychological discipline non-negotiable.

Why the Transition Is Difficult

Many traders fail funded evaluations not because their strategy stops working, but because their retail trading psychology doesn’t translate to a rules-based environment.

Retail traders are used to flexibility.

Funded traders must embrace structure.

Those who successfully adapt learn to:

- trade smaller and more consistently

- respect rules over emotions

- prioritize survival over excitement

Once this shift occurs, funded trading becomes far more manageable — and sustainable.

Understanding this psychological difference is essential before attempting a funded account. The mindset that works in retail trading is rarely enough in a professional, rules-driven environment.

Common Trading Psychology Mistakes

Even experienced traders can fall into psychological traps that negatively affect their trading behaviour and overall performance in the markets. These mistakes often have little to do with trading strategy and everything to do with how emotions and biases influence making decisions based on short-term outcomes.

1. Overtrading

Overtrading is one of the fastest ways to breach rules and damage trading outcomes.

It usually happens when traders:

- feel pressure to hit profit targets quickly

- trade out of boredom rather than opportunity

- try to recover losses after losing money

In fast-moving financial markets, more trades do not mean more profitable trades.

More trades often mean more emotional decisions — and more mistakes.

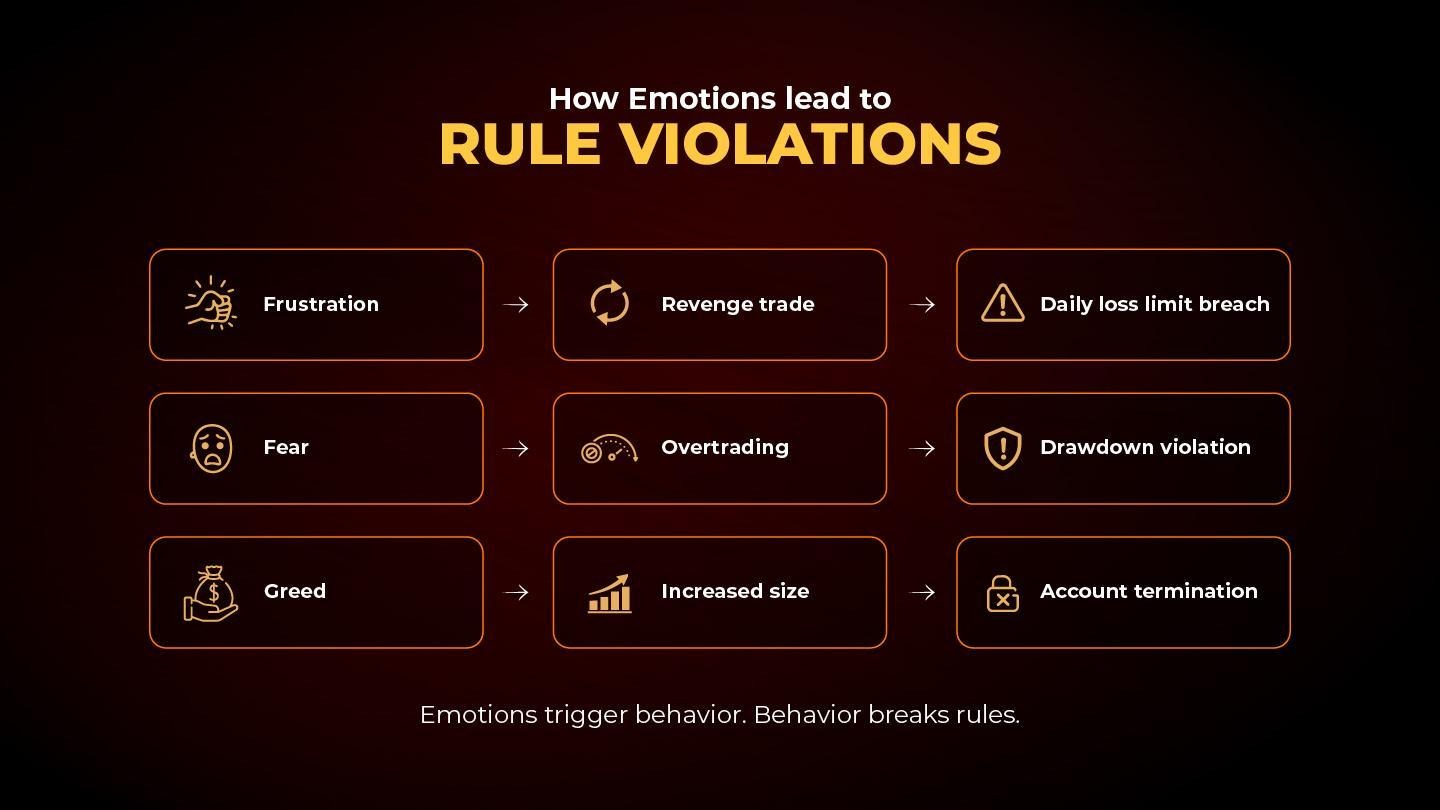

2. Revenge Trading

After a loss, many traders feel an emotional urge to “get it back.”

This behaviour often causes a trader to:

- increase position size unnecessarily

- ignore stop-loss rules

- enter trades impulsively without confirmation

Revenge trading is a clear example of how emotions and biases can cause a trader to abandon logic. It almost always results in breaching daily loss limits or drawdowns.

3. Fear-Based Decision Making

Fear can be just as damaging as greed in market trading.

Fear-based trading often leads traders to:

- exit winning trades prematurely

- hesitate when buying or selling

- avoid valid setups during selloffs or volatile conditions

- close positions early. Instead they should stay in a position longer if the trade respects market structure.

This behaviour reduces the ability to make rational decisions and creates inconsistency — and inconsistency fails evaluations.

4. Overconfidence After Wins

A short winning streak can quickly make traders overconfident, especially when recent trading experience has been positive.

Overconfidence often leads to:

- increasing position size without justification

- ignoring risk limits

- holding a position for too long instead of planning a proper market structure level to exit a position

This psychological shift frequently marks the turning point where success or failure begins to make or break a funded account.

These mistakes are common because trading constantly tests emotional control. Recognizing them early can help you avoid costly errors, improve decision-making, and build habits that support long-term consistency as a good trader.

How to Build Strong Trading Psychology: Practical Routines for Funded Traders

The psychology of trading is shaped by habits, routines, and how traders respond to uncertainty in the financial markets. Strong trading psychology is not about eliminating emotion, but about managing emotions and biases so they don’t control execution. The routines below are designed to help funded traders improve trading psychology through structure and consistency.

Daily Mental Routine (Before the Trading Day)

Before markets open, take time to mentally prepare for the session ahead:

- Review your maximum risk and loss limits

- Remind yourself that today’s trades do not define success or failure

- Acknowledge current market conditions, including slower periods or bear markets

This routine helps neutralize emotional expectations before market trading begins. Many traders fail not because of strategy, but because greed can lead them to overtrade or force opportunities that don’t exist.

Pre-Trade Routine (Before Every Entry)

Before entering any position, pause briefly and assess your intent:

- Is this trade aligned with my plan and trading strategy?

- Am I entering based on logic, not impulse or recent outcomes?

- Am I trying to predict outcomes, or simply execute my edge?

This step protects traders from common errors like the gambler’s fallacy, where recent wins or losses distort expectations. Good execution depends on resisting emotional shortcuts when buying or selling.

Post-Trade Routine (After Wins and Losses)

After each trade or session:

- Record the result and your emotional response

- Note whether you followed rules for entries, risk, and take profits

- Step away if emotions feel elevated

This process highlights how personality traits and emotional reactions influence trading outcomes over time. Journaling makes patterns visible — especially those that quietly undermine consistency.

Core Psychological Principles Every Funded Trader Must Apply

1. Shift Focus from Profit to Process

Professional traders understand that focusing on outcomes alone damages decision-making.

Instead of measuring success by money made or lost, evaluate:

- quality of execution

- discipline under pressure

- consistency across sessions

This mindset separates traders who survive from those whose psychology can make or break a funded account.

2. Define Clear Personal Rules (Beyond Firm Rules)

Funded traders must operate with stricter personal limits than the firm requires.

These rules reduce emotional exposure and support long-term performance for both traders and investors. Clear boundaries protect against impulsive behaviour during volatile conditions.

3. Accept Losses as a Normal Business Cost

Losses are part of trading. Emotional resistance to them is not.

When traders accept losses professionally, they reduce the urge to interfere with trades, hold positions emotionally, or seek control where none exists. Acceptance strengthens the ability to make rational decisions under pressure.

4. Reduce Position Size to Reduce Emotional Load

Smaller risk reduces emotional attachment.

Lower exposure helps traders think clearly, especially after losses or during uncertain market phases. This is often the opposite of greed — prioritizing longevity over excitement.

5. Create a Pre-Trade Checklist

A checklist prevents emotional overrides in fast-moving markets.

It ensures decisions are based on structure, not impulse, and helps traders avoid behaviours that negatively impact trading performance. Over time, this habit builds discipline that compounds with experience.

Traders who commit to these routines develop consistency regardless of market conditions. Many professionals also reinforce these habits by studying books on trading psychology, which help deepen self-awareness and emotional control over time.

Strong trading psychology is built, not inherited — and it’s one of the most reliable ways to improve long-term performance.

The Role of Discipline in Funded Trading

Discipline is the ability to follow rules even when emotions disagree.

In funded trading, discipline is not about motivation or confidence — it’s about consistency under pressure. Traders who succeed understand that discipline is shaped by characteristics that influence decision-making, such as patience, emotional control, and respect for risk.

Disciplined traders:

- stop trading after hitting loss limits

- avoid forcing trades during slow periods

- respect drawdown rules

- stay patient when conditions are unclear

Undisciplined traders, by contrast, make decisions based on how they feel in the moment. They chase trades, ignore rules, and react emotionally to short-term outcomes.

In a funded environment, discipline is non-negotiable. Rules exist to protect capital, and only traders who consistently follow them are able to remain funded and perform over the long term.

How to Handle Losing Days Without Breaking Rules

Step 1: Stop Trading Early

One losing day doesn’t define your performance. Continuing to trade emotionally does.

Step 2: Reduce Risk the Next Session

Lowering risk after a loss rebuilds confidence and control.

Step 3: Review, Don’t React

Analyze your trades objectively. Emotional reactions distort learning.

Mental Techniques Used by Professional Traders

1. Detachment from Outcome

Professionals treat each trade as one of many—not a defining moment.

2. Routine-Based Trading

Consistent routines reduce impulsive behavior.

3. Journaling Emotions

Tracking emotional states helps identify patterns that lead to mistakes.

4. Visualization

Visualizing calm execution before trading reduces anxiety during live markets.

Trading Psychology Is a Skill—Not a Trait

Good psychology isn’t something you’re born with. It’s built through:

- repetition

- structure

- self-awareness

- controlled risk exposure

Every trader struggles emotionally at some point. The difference is whether they adapt—or repeat the same mistakes.

Frequently Asked Questions (FAQs)

1. What is trading psychology?

Trading psychology refers to the mental and emotional factors that influence how traders make decisions. It includes discipline, emotional control, confidence, and the ability to follow a trading plan consistently—especially during losses or high-pressure situations.

2. Why is trading psychology important for funded traders?

Funded traders operate under strict rules such as daily loss limits and drawdown thresholds. Poor trading psychology often leads to emotional decisions like overtrading or revenge trading, which result in rule violations and account termination—even when the strategy is profitable.

3. What emotions cause traders to violate funded trading rules?

The most common emotions are:

- Fear (closing trades too early or hesitating)

- Greed (oversizing positions or forcing trades)

- Frustration (revenge trading after losses)

- Overconfidence (ignoring risk limits after wins)

These emotions directly contribute to drawdown breaches and daily loss limit violations.

4. How can I stop overtrading in a funded account?

To reduce overtrading:

- Set a maximum number of trades per day

- Trade only pre-defined setups

- Walk away after reaching your daily profit or loss limit

- Focus on quality trades, not frequency

Structure removes emotional impulses.

5. Why do traders revenge trade after a loss?

Revenge trading is an emotional response driven by frustration and the desire to recover losses quickly. It bypasses logic and risk management, leading to oversized positions and rule breaches. The solution is accepting losses as part of trading and stepping away after a losing trade.

6. How can I improve my trading discipline?

Discipline improves through:

- clear written trading rules

- smaller position sizes

- pre-trade checklists

- consistent routines

- journaling both trades and emotions

Discipline is built through repetition and structure—not willpower alone.

7. Does reducing position size really help trading psychology?

Yes. Smaller position sizes reduce emotional pressure, fear, and impulsive behavior. When risk feels manageable, traders think more clearly and are more likely to follow their rules consistently.

8. How should funded traders handle losing days?

The best approach is:

- stop trading early

- avoid trying to recover losses the same day

- review trades calmly

- reduce risk in the next session

One bad day doesn’t fail an account—emotional reactions do.

9. Can good trading psychology make an unprofitable strategy work?

Good trading psychology won’t fix a bad strategy, but poor psychology can ruin a good one. When combined with a reasonable edge, strong discipline and emotional control significantly increase long-term consistency.

10. Is trading psychology something you’re born with?

No. Trading psychology is a skill developed over time through experience, self-awareness, and structured habits. Every trader struggles emotionally at some stage—the key is learning from those experiences and adjusting behavior.

Final Thoughts

In funded trading, trading psychology is not optional—it’s essential.

You can have a profitable strategy, solid market knowledge, and perfect entries, but without emotional control and discipline, none of it matters. Most rule violations come from psychological lapses, not technical errors.

Mastering trading psychology means:

- staying calm under pressure

- respecting rules consistently

- accepting losses professionally

- focusing on long-term consistency

If you want to stay funded, grow accounts, and trade professionally, your mindset must evolve alongside your strategy.

In the end, funded trading rewards not the smartest trader, but the most disciplined one.

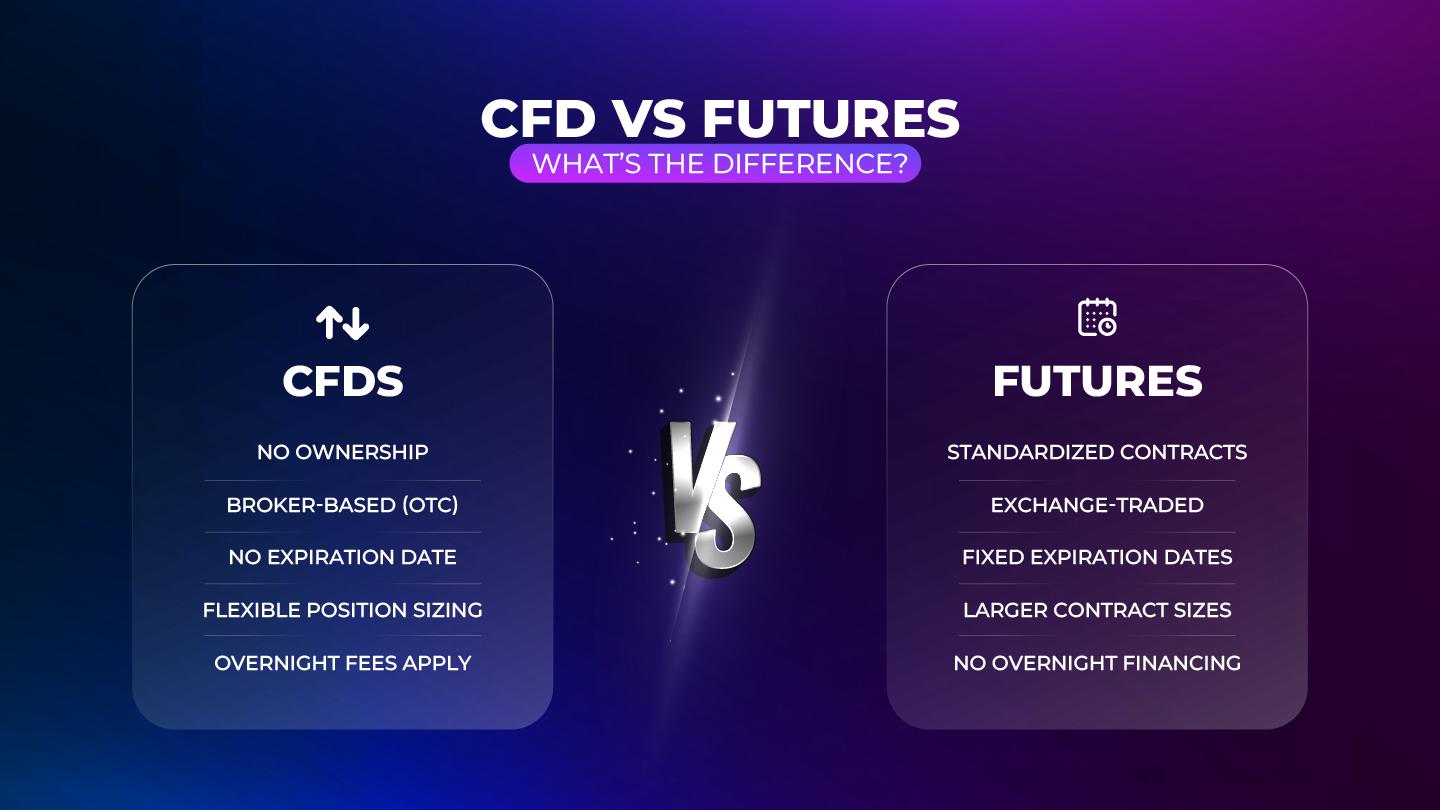

Build discipline, manage emotions, and trade within the rules — apply for a funded Futures or CFD account with 4PropTrader and put professional trading psychology into practice.

.jpg)