Quick Summary

Choosing a CFD broker is one of the most important decisions you will make at the start of your CFD trading journey. CFDs, or Contracts for Difference, allow CFD traders to speculate on price movements across a wide range of global markets without owning the underlying asset. While this form of online CFD trading allows flexibility and access to multiple CFD markets, it also comes with a high risk of losing money, especially when trading with leverage

Not all CFD brokers and trading platforms operate under the same standards. Differences in regulation, trading costs, platform technology, and risk management tools can significantly impact your trading experience. Choosing the right CFD broker helps ensure a stable trading environment, transparent pricing, and access to tools that support informed trading decisions.

Whether you are new to CFDs or looking to upgrade to a more advanced trading platform, understanding how to evaluate a broker properly can help you avoid common pitfalls and select a CFD broker for your trading needs. In this guide, we'll break down the key factors every trader should consider when choosing a CFD broker, helping you find the best possible fit for your trading style and goals.

Introduction

CFD trading gives traders access to global markets, flexible trading options, and the ability to profit from both rising and falling price movements. Through online CFD trading, traders can speculate using leverage, trade on margin, and access a wide range of instruments from a single trading platform. However, these opportunities also come with a high risk of losing money, especially when trades involve leverage

This is why choosing a CFD broker is just as important as developing effective trading strategies. A poor broker choice can result in: - Unfavorable trading conditions - High or hidden trading costs - Unstable platforms, or difficulties when trading with real money. In extreme cases, traders may even lose money when trading CFDs, not because of poor strategy, but because the broker environment is not suited to their trading needs.

A well-chosen CFD broker with a stable trading environment supports informed trading by offering:

- Transparent pricing,

- Reliable execution,

- Robust risk management tools.

Whether you are at the beginning of your trading journey or looking to upgrade to a more advanced trading platform, understanding how to choose a CFD broker can significantly impact your long-term results.

What is a CFD broker?

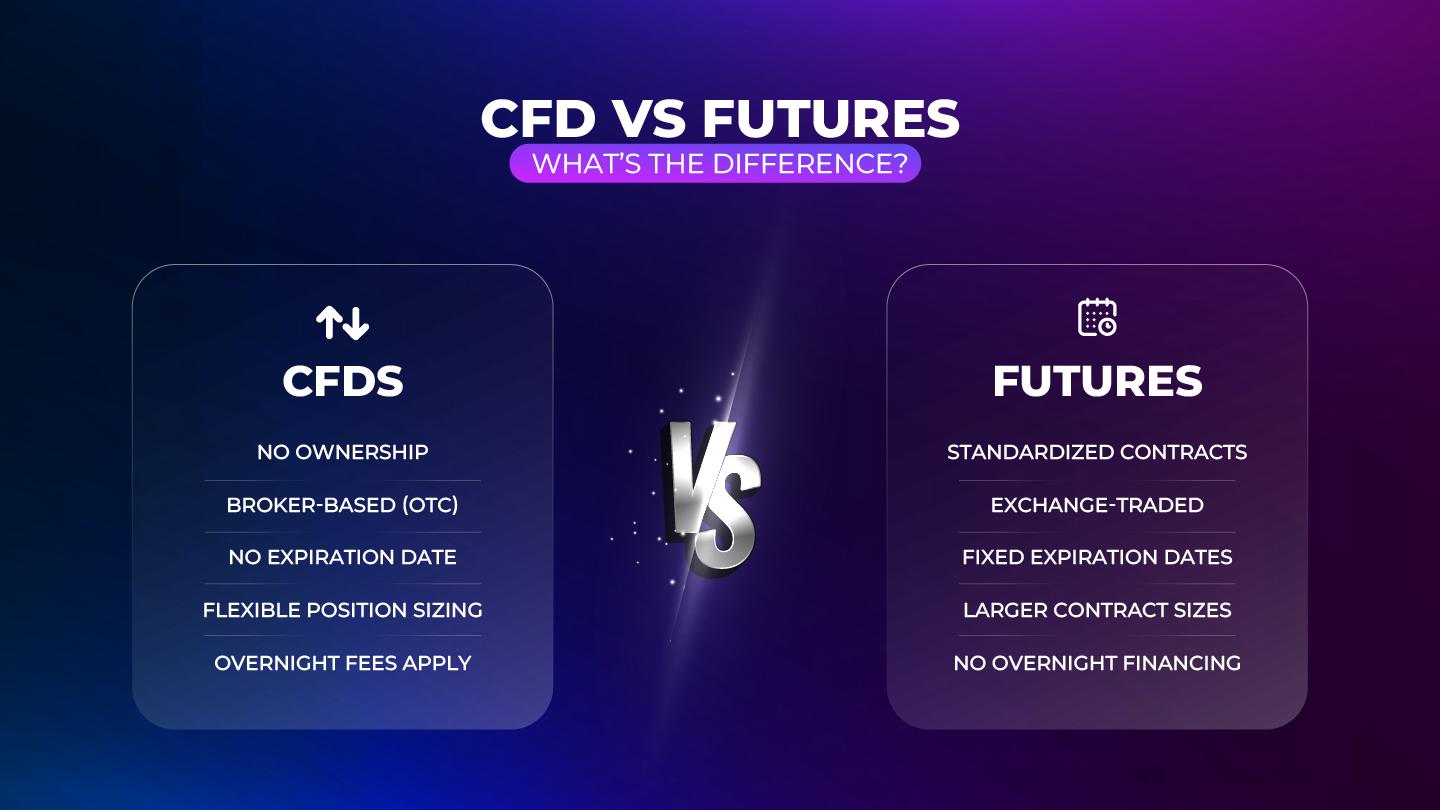

A CFD broker is a financial services provider that enables traders to trade CFDs. Rather than buying or selling the underlying asset itself, forex and cfd traders speculate on price movements, aiming to profit from both rising and falling markets.

In practice, the broker acts as the counterparty to the trade and provides the infrastructure needed to open and manage a CFD trading platform. This includes pricing, trade execution, margin requirements, and access to various CFD markets.

Most top CFD brokers offer access to a broad range of markets, including:

- Stocks

- Indices

- Forex

- Commodities

- Cryptocurrencies

Since CFDs are leveraged instruments, traders can control larger positions with a smaller amount of capital. While this structure can amplify potential gains, it also comes with a high risk of losing money, particularly when trading on margin.

Understanding what a CFD broker offers, how trades are executed, and how risks are managed is essential when choosing a broker that aligns with your experience level, and long-term objectives.

Why Choosing the Right CFD Broker Matters

Unlike stock exchanges, CFDs are traded over-the-counter (OTC). This means:

- Prices come from the broker

- execution quality depends on the broker

- your capital safety depends on the broker

A good broker supports your trading.

A bad one works against you.

That's why broker selection is not optional — it's foundational.

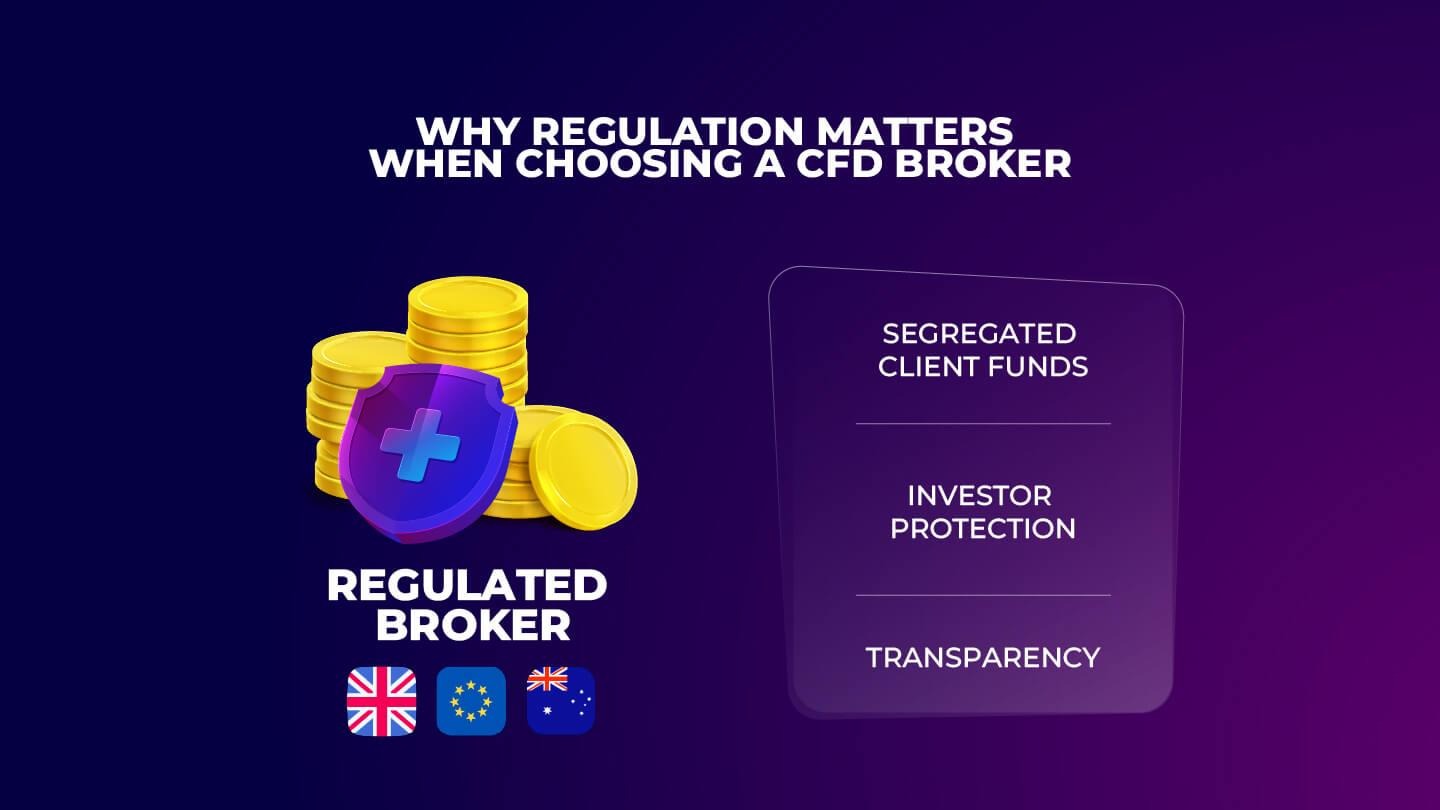

1. Regulation and Licensing (Non-Negotiable)

The first and most important factor when choosing a CFD broker is regulation. A broker that is regulated operates under strict legal and financial standards designed to protect retail trading clients and ensure fair market access.

A regulated broker ensures compliance with key requirements, including:

- Capital requirements to maintain financial stability

- Client fund segregation , keeping trader funds separate from company funds

- Transparency in pricing, fees, and execution

- Fair trading practices that support informed and ethical trading

When trading CFDs—where trading on margin and leverage can expose traders to a high risk of losing money—regulation plays a critical role in safeguarding your trading account and overall trading experience.

Reputable regulators include:

- FCA (UK)

- ASIC (Australia)

- CySEC (Cyprus)

- BaFin (Germany)

- MAS (Singapore)

If a CFD broker is not regulated—or is regulated in a questionable offshore jurisdiction—it represents a serious risk to your capital and long-term trading decisions

Rule of thumb:

If regulation details are hard to find or unclear, walk away. Otherwise, you are at risk of losing your money.

2. Client Fund Protection

Client fund protection is a critical safeguard when trading CFDs, especially when trading with real money in a leveraged trading environment. A trustworthy CFD broker implements strict measures to protect client capital and reduce the risk of losing your money due to operational or financial issues at the broker level.

One of the most important protections is client fund segregation. This means your funds are held separately from the broker's own operating capital. In the event of financial distress or insolvency, segregated funds help ensure that client money is not used to cover company liabilities.

Many regulated brokers are also part of investor compensation schemes, which may provide limited protection if a broker fails. While this does not eliminate risk, it adds an extra layer of security for retail trading clients.

Before opening a trading account, find the best broker and always confirm how the broker handles client funds. If fund protection policies are unclear or poorly explained, don't take the high risk as this is a warning sign that should not be ignored.

3. Trading Costs and Fees

Understanding trading costs is a core part of the best platform, as trading fees can directly affect profitability over time—especially for active CFD traders. Even small costs add up when trading frequently or using leverage.

Most CFD brokers offer several types of fees, which may vary depending on the trading platform, asset class, and trading style.

Common CFD Trading Costs Include:

- Spreads – the difference between the buy and sell price

- Commissions – charged per trade by some brokers

- Overnight (swap) fees – applied when holding positions overnight

- Inactivity fees – charged if a trading account is unused for a period

- Withdrawal fees – applied when moving funds out of the account

Some brokers promote commission-free trading, but this often comes with wider spreads or higher swap fees. For this reason, it's important to evaluate the total trading costs, not just the headline pricing.

Before opening a trading account, review the broker's full fee structure carefully. Transparent pricing and fair trading conditions are signs of a broker that supports long-term, informed trading rather than short-term volume.

4. Leverage and Margin Requirements

Leverage is one of the defining features of CFD trading, but it is also one of the biggest sources of risk. Leverage allows traders to control larger positions with a smaller amount of capital, meaning trading on margin can amplify both gains and losses.

Because of this, accounts lose money when trading CFDs much more quickly when leverage is misused. In volatile markets, traders can lose money rapidly due to leverage, even if price movements are relatively small. This is why CFDs are considered products that come with a high risk, and why they are not suitable for everyone—especially those who cannot afford to take the high risk involved.

Responsible CFD brokers offer clearly defined margin requirements, realistic leverage limits, and transparent risk disclosures. A well-regulated broker will also adjust leverage based on asset class, market conditions, and whether a trader is classified as retail or professional.

When choosing the right CFD broker, it's essential to understand how leverage works on the platform for CFD trading, how margin calls are handled, and what protections are in place to limit the risk of losing your money. Used correctly, leverage can support strategic trading—but without discipline and risk controls, it can quickly undermine even experienced traders.

5. Range of Markets Available

The range of markets a broker supports can significantly shape your overall trading experience and ability to adapt to changing conditions. A CFD broker that offers access to multiple asset classes allows traders to diversify, manage risk more effectively, and pursue different trading strategies within one account.

Most CFD brokers offer trading across major global markets, including:

- Forex and CFDs , covering major, minor, and exotic currency pairs

- Indices , allowing traders to speculate on broader market performance

- Stocks , offering exposure to individual companies

- Commodities , such as gold, oil, and agricultural products

- Cryptocurrencies , depending on regulatory availability

CFD trading allows traders to speculate on price movements without owning the underlying asset, making it possible to trade both rising and falling markets. This flexibility is particularly valuable for forex trading and index trading, where market volatility can create frequent opportunities.

When selecting the right CFD broker, consider whether the broker's market offering aligns with your trading needs and long-term objectives. A broker that offers trading across a wide range of instruments is better equipped to support diverse trading needs and evolving strategies as you gain experience.

6. Trading Platforms and Technology

Your trading platform is the core of your daily trading activity. Even the best CFD broker can fall short if the technology behind the platform is unreliable, slow, or lacks essential tools. The right CFD broker should provide a platform for CFD trading that is stable, intuitive, and capable of supporting both simple and advanced trading strategies.

Most CFD brokers offer access to one or more CFD platforms, which may include web trading, desktop software, or a CFD trading app for mobile use. A feature-rich trading platform typically includes real-time charts, multiple order types, technical indicators, and integrated trading tools that help traders analyze markets and execute trades efficiently.

When evaluating platforms, look for flexibility. The best CFD trading platform should support manual trading as well as automated trading, allowing traders to adapt their approach as their trading experience grows. For beginners, a clean interface and easy navigation are essential. For more experienced or professional trading styles, advanced charting, fast execution, and customization options become increasingly important.

Before committing real money, always test the platform using demo access if available. The best platform for CFD trading is one that aligns with your trading needs, supports your strategy, and performs consistently during high-volatility market conditions.

7. Execution Model and Transparency

A broker's execution model determines how your trades are processed, priced, and filled—making it a critical factor when selecting top CFD brokers. Since CFDs are traded over-the-counter, the type of broker you choose directly affects execution quality and trading fairness.

At a basic level, a CFD broker acts as the broker to exchange the difference between an asset's opening and closing price. Brokers may operate using different execution models, such as market maker or agency-based structures. What matters most is not the label, but whether the broker offers trading with transparency, consistency, and minimal conflicts of interest.

A reliable CFD broker that offers transparent execution clearly explains:

- how prices are derived

- How are orders filled?

- whether slippage or requotes may occur

- how client interests are protected

Because CFD trading allows traders to speculate on fast-moving markets, execution speed and pricing accuracy are essential for informed trading. Poor transparency can lead to unexpected outcomes that negatively affect trading decisions, even when strategies are sound.

When evaluating brokers, look for clear documentation, honest disclosures, and a track record of fair execution. Transparency is a key characteristic of brokers that support stable trading and long-term success.

8. Risk Management Tools

Strong risk management tools are a sign of one of the best CFD brokers that care about trader longevity.

Essential features include:

- stop-loss orders

- take-profit orders

- negative balance protection

- margin alerts

- guaranteed stop-losses (in some cases)

These tools help prevent catastrophic losses — especially in volatile markets.

9. Account Types and Minimum Deposits

Some brokers offer demo accounts as well as multiple account types with different:

- spreads

- commissions

- leverage

- minimum deposits

Choose an account that matches your experience level and capital.

Be cautious of brokers that require very high minimum deposits without clear added value.

10. Deposits and Withdrawals

A reliable CFD broker makes it easy to move your money.

Check:

- Available payment methods

- Processing times

- Fees

- Withdrawal conditions

Delays, excessive paperwork, or unexplained rejections are major warning signs

A good broker is transparent and efficient with withdrawals.

11. Customer Support Quality

When something goes wrong, support matters.

Look for:

- Multiple contact options (chat, email, phone)

- Fast response times

- Knowledgeable agents

- Local language support (if needed)

Test support with a simple question before opening an account

12. Education and Research Tools

Quality brokers invest in trader education.

Useful resources include:

- beginner guides

- webinars

- market analysis

- Economic calendars

- Trading tutorials

While education doesn't replace experience, it shows the broker is serious about long-term clients

13. Reviews and Reputation

Always research broker reviews of what other traders are saying.

Check:

- Independent review sites

- Trading forums

- Trustpilot-style platforms

No broker is perfect — but repeated complaints about withdrawals, slippage, or account closures should not be ignored.

Red Flags to Avoid When Choosing a CFD Broker

Avoid brokers that:

- promise guaranteed profits

- pressure you to deposit quickly

- Offer unrealistic bonuses

- Lack of clear regulation

- Hide fees in fine print

- make withdrawals difficult

If something feels off, it probably is.

How to Choose a CFD Broker: Step-by-Step Checklist

- Confirm regulation and licensing

- Verify fund protection policies

- Review spreads, commissions, and swaps

- Test the trading platform

- Check leverage and margin rules

- Confirm risk management tools

- Research reputation and reviews

- Test deposits and withdrawals

- Contact customer support

- Start small and scale gradually

This checklist keeps emotion out of the decision and puts structure in its place

Focus on your strategy, not the broker — trade CFDs under 4Proptrader's proprietary trading

funded program and access professional-grade conditions.

Frequently Asked Questions (FAQs)

1. Is it safe to trade CFDs?

CFDs are safe when traded through a regulated broker and with proper risk management. The product itself is high-risk due to leverage.

2. Should beginners trade CFDs?

Beginners can trade CFDs, but they should start small, use low leverage, and focus heavily on risk management.

3. What's the most important factor when choosing a CFD broker?

Regulation. Without it, nothing else matters.

4. Are low spreads always better?

Not necessarily. Low spreads can be offset by high swaps or commissions. Always evaluate total trading costs.

5. Can I change CFD brokers later?

Forks. Many traders switch brokers as their needs evolve. Starting with a small deposit makes this easier.

.jpg)