Quick Summary

A daily loss limit is the maximum amount of money a trader can lose in a single day while trading with a prop firm. It protects both the trader from blowing an account too quickly and the firm from uncontrolled risk. Understanding how daily loss limits work—and managing them effectively—is essential to staying funded. In this guide, we’ll break down what a daily loss limit is, why it matters in prop trading, and proven strategies to help traders stay disciplined.

Introduction

One of the first things new traders discover when exploring proprietary (prop) trading is that rules matter. Prop firms aren’t just handing out their capital with no guardrails—they set strict conditions to protect both themselves and their traders. Among the most important of these rules is the daily loss limit.

For aspiring funded traders, understanding and respecting this rule is the difference between keeping an account active and being cut off from the opportunity. In this guide, we’ll explore the meaning of a daily loss limit, why prop firms rely on it, and most importantly, how you can manage it to trade smarter.

What Is a Daily Loss Limit?

A daily loss limit is the maximum loss limit a trader is allowed to take in a single trading day. If this limit is breached—even by a few dollars—the funded trading account may be suspended or terminated, depending on the firm’s rules.

Think of it as a safety net:

-

It prevents a trader from chasing losses and blowing up the account in one bad session.

-

It ensures the firm’s capital is protected from excessive risk.

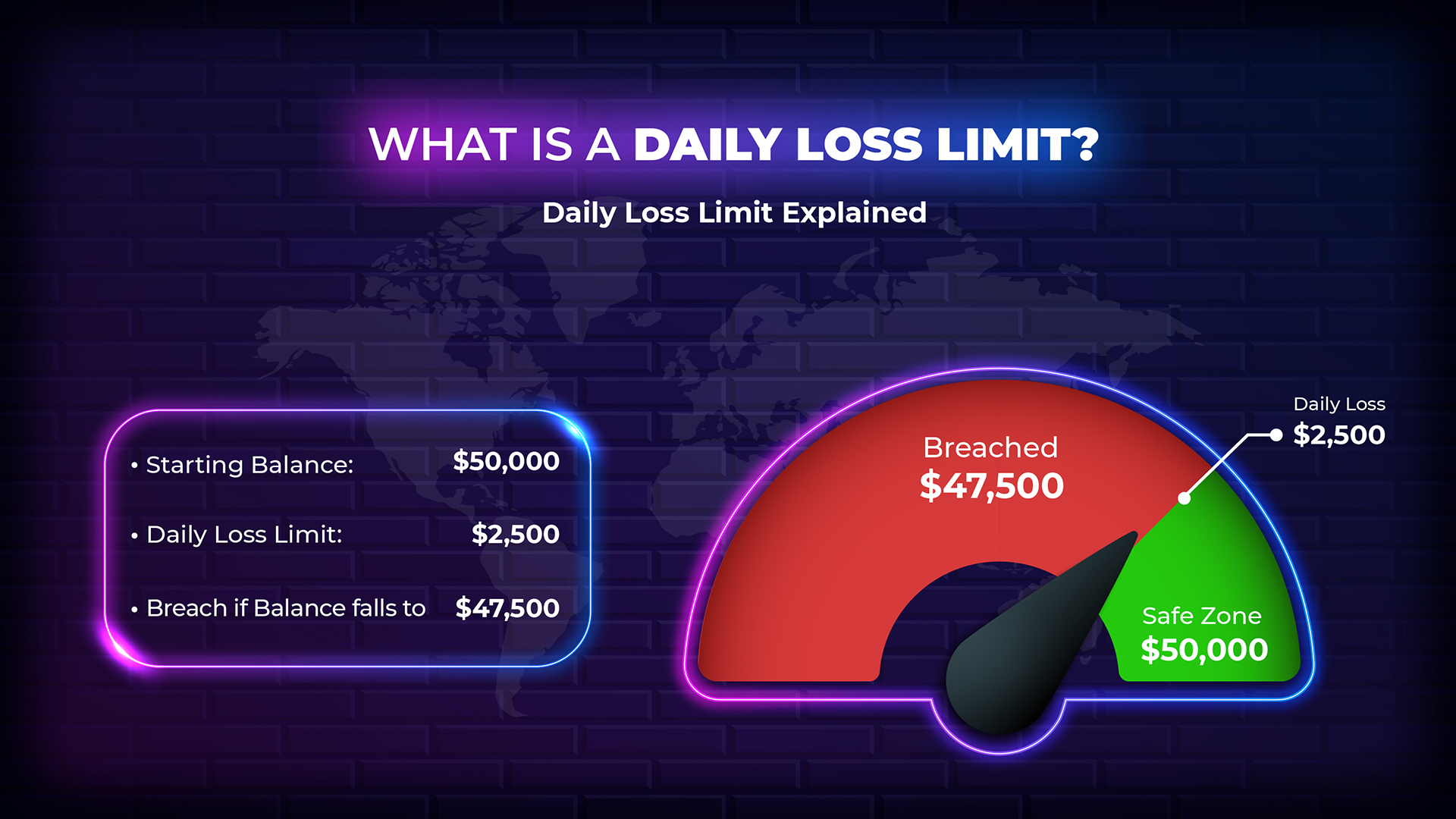

Example of a Daily Loss Limit

Suppose you’re trading a $100,000 funded account with a maximum daily loss limit of $3,000 (3%). If your account balance falls by more than $3,000 loss within a single day (including open positions), you’ll have violated the rule and likely lose your funded account.

Some firms calculate this maximum loss limit at the close of the day, while others use a real-time breach system—meaning if your open trades put you past the max daily loss limit even temporarily, you’re out.

Why Do Prop Firms Use Daily Loss Limits?

Prop firms are in the business of risk management. They want profitable traders, but they can’t afford reckless behavior. Daily loss limits serve several purposes:

-

Capital Protection

Firms don’t want traders blowing through large sums of capital in a single bad session. The limit is set to put a cap on damage. -

Trader Discipline

Loss limits force traders to recognize when it’s time to stop trading for the day. Walking away can be hard in the heat of trading, but a rule makes it non-negotiable. -

Longevity in Trading

By stopping daily blowups, traders get more chances to prove their consistency over time. -

Psychological Safety

Knowing there’s a hard stop reduces the urge to “revenge trade” or risk spiraling deeper into losses.

Common Daily Loss Limit Structures in Prop Trading

Not all firms calculate daily loss limits the same way. Here are the most common approaches:

1. Fixed Dollar Amount

A set limit (e.g., $2,000 per day). Simple and easy to track.

2. Percentage of Account Size

Often around 2–5% of account equity. For a $50,000 account, this might be $1,500–$2,500.

3. Trailing Loss Limit

Some firms use a trailing model, where the loss limit moves up as your profits grow. While this rewards consistency, it also tightens the margin for error as you succeed.

4. Inclusion of Open Drawdown

Certain firms include floating losses from open trades in the daily calculation. This means even if you close in profit, a temporary dip past the limit could disqualify you.

Why Daily Loss Limits Matter to Traders

For traders, the daily loss limit isn’t just a rule—it’s a psychological and strategic checkpoint.

-

Keeps emotions in check: It forces you to stop trading when emotions are likely at their peak.

-

Encourages risk management: To stay compliant, you need to size positions using a risk management tool appropriately and set realistic stop losses.

-

Tests professionalism: Funded futures trading isn’t just about making money; it’s about proving you can respect rules.

Breaching a daily loss limit is one of the most common reasons traders lose funded accounts, often more than failing to hit profit targets.

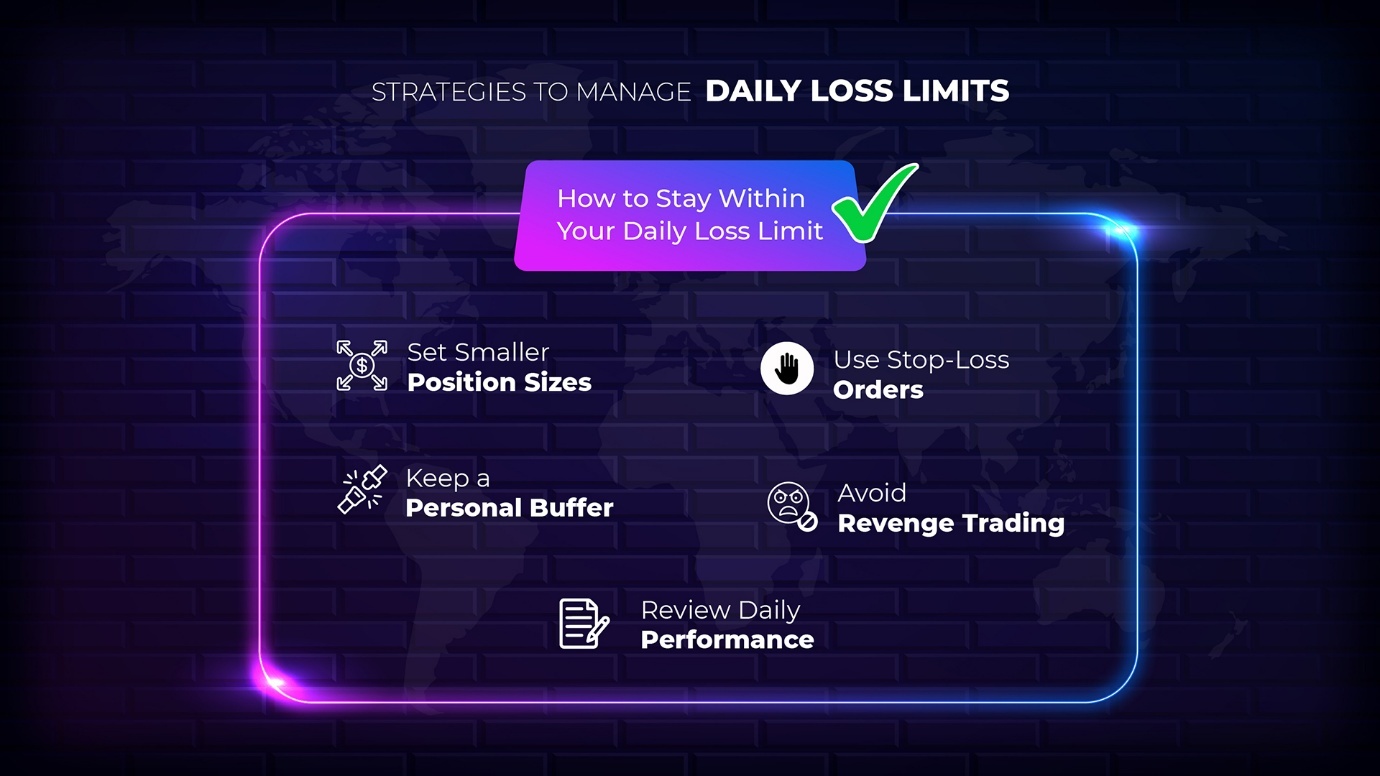

Strategies to Manage Your Daily Loss Limit

Here are practical strategies that can help you stay safe:

1. Risk Less Per Trade

If your daily loss limit is $2,000, risking $1,000 per trade leaves no room for error. Instead, cap risk at 1–2% of your daily limit. This allows multiple opportunities without sudden elimination.

2. Set a “Personal” Limit Below the Firm’s

If the firm’s limit is $2,000, set your own at $1,500. This buffer ensures you won’t accidentally breach due to slippage, commission, or open trade fluctuations.

3. Avoid Overtrading

Taking too many trades increases the chance of a bad streak to incur that pushes you past the limit. Stick to quality setups only to secure trading capital.

4. Use Daily Stop Loss Orders

Some platforms enable you to set a maximum daily loss that automatically stops you from trading further once hit. This enforces discipline.

5. Journal Your Emotions

Recognize the urge to “get it back” after a losing trade. Writing down how you feel helps cut through impulses that lead to breaches.

6. Quit While Ahead

If you’ve had a profitable morning, don’t feel compelled to keep trading for the remainder of the trading session. Many traders lose their daily gains by overstaying in the market.

Common Mistakes Beginners Make with Daily Loss Limits

-

Not Tracking Real-Time Equity

Many traders focus only on closed trades, forgetting that unrealized drawdowns also count. You need to keep track and monitor this from your platform’s dashboard. -

Trading Too Large

Oversized positions can liquidate the daily limit in one or two trades. -

Revenge Trading

Trying to make back a loss quickly often leads to bigger losses and breaches. -

Ignoring Slippage and Fees

Sometimes it’s not the trade setup that breaches the limit, but unexpected execution costs. -

Failing to Adjust for Market Conditions

High-volatility days require smaller position sizes. Not adapting can exceed past limits faster than usual.

The Psychological Side of Daily Loss Limits

Daily loss limits aren’t just financial—they’re emotional speed bumps.

-

Frustration: Traders often feel punished for “just one mistake.”

-

Fear of Missing Out (FOMO): Hitting the limit early can make you feel like you’re missing big moves later.

-

Guilt: Many traders spiral into self-blame after the loss limit is reached.

The key is to see the rule not as a restriction, but as a shield that saves you from yourself on bad days.

Frequently Asked Questions (FAQs)

1. What is a daily loss limit in prop trading?

A daily loss limit is the maximum amount a trader is allowed to lose in a single day while trading with a proprietary firm. If the limit is exceeded—even by a small amount—the account may be auto-liquidated

2. Why do prop firms set daily loss limits?

Prop firms such as fundednext and topstep, use daily loss limits to protect their capital, encourage discipline, and prevent traders from blowing up their future accounts in a single bad session. It also forces traders to develop risk management skills, which are essential for long-term profitability.

3. How do daily loss limits work in practice?

If you have a $100,000 funded account with a daily loss limit of $3,000, you cannot lose in a single trading day more than $3,000 in closed or open positions. Breaching this rule usually results in losing your funded status.

4. Do unrealized (floating) losses count toward the daily loss limit?

Yes, in many firms they do. Even if you close in profit later, if your open positions dip past the loss limit at any point, you may breach the rule and cannot resume trading. Always check your firm’s policy on whether floating drawdowns are included.

5. What happens if I hit my daily loss limit?

Most firms will immediately disqualify your account, and for most firms, you cannot reset the funded account. Others may suspend trading access for the rest of the day. Either way, you will not be able to continue trading until the next trading day session, if at all.

6. How can I avoid breaching my daily loss limit?

The best ways include:

-

Risking less per trade

-

Setting a personal loss limit below the firm’s on your trading platform

-

Avoiding overtrading

-

Using daily stop-loss features on your platform

-

Journaling your trades and emotions

7. What’s a good personal daily loss limit?

A smart approach is to set your personal daily loss limit about 20–30% below the firm’s official limit. For example, if the firm allows $3,000, set your own cutoff at $2,200–$2,400 to leave a safety buffer and have a soft breach below the firm’s hard breach threshold.

8. Can daily loss limits change as I make profits?

In some prop firms, yes. Certain firms use a trailing daily loss limit, where the maximum allowed loss adjusts as your profits increase. This makes risk tighter as you succeed, so you’ll need to adapt position sizing accordingly.

Final Thoughts

The daily loss limit is one of the most critical rules in prop trading. It may feel restrictive, but it exists to help traders protect themselves and their accounts. Understanding the rule, respecting its boundaries, and developing strategies to stay well within it are what separate successful funded traders from those who burn out.

Think of the daily loss limit as more than a rule—it’s a tool for building consistency and professionalism. By mastering it, you’re not just following firm requirements; you’re building the mindset of a disciplined, long-term trader.