Quick Summary

Funded trading account requirements are the rules and performance metrics a trader must meet to qualify for access to a prop firm’s capital. These typically include hitting profit targets, following daily loss and drawdown limits, maintaining good risk management, and demonstrating consistent, disciplined trading.

In this guide, we break down everything you need to know about funded trading account requirements, how they work, what trading firms look for, and how you can meet them to start trading with prop firm capital successfully.

Introduction

The idea of trading with someone else’s money is appealing for good reason. Prop trading programs offered by proprietary trading firms give skilled traders access to large accounts without needing to risk their own capital.

But before you can trade a firm’s money, you need to prove yourself. Prop firms don’t hand out funding to anyone who can click “buy” and “sell.” They use evaluation programs designed to filter disciplined, risk-aware, and profitable traders from the rest.

This article breaks down the funded trading account requirements you’ll encounter, what they mean, and how to meet them.

What Is a Funded Trading Account?

A funded trading account is an account provided by a prop firm that allow traders to trade using the firm’s capital.

You don’t invest your own money, instead, you trade within strict parameters that protect the firm’s funds. In return, you share a percentage of the profits, often keeping 70–90%.

However, before gaining access to the funded account, you must pass an evaluation process to prove your trading consistency and discipline.

Why Funded Trading Account Requirements Exist

Funded trading firms operate on trust and data. They must ensure that the traders they back can manage risk and follow the rules as well as they pursue profits.

Funded trading accounts requirements:

-

Protect the firm’s capital.

-

Encourage traders to develop disciplined habits as they trade to pass the evaluation and get a funded account.

-

Create a fair system to reward disciplined trading over luck or reckless risk-taking.

Common Funded Trading Account Requirements

1. Profit Target

This is the minimum amount of profit you need to generate during the evaluation period to become a funded trader.

-

Typical range: 8–10% of the starting account balance.

-

Example: For a $100,000 demo account, you must earn $8,000–$10,000 to qualify.

Tip: Focus on steady, controlled profits. Many traders fail by over-leveraging early and using gambling like trading strategies to reach targets faster and get funded.

2. Daily Loss Limit

This rule caps how much you can lose in a single trading day.

-

Usually 2–5% of the account balance.

-

Example: A $100,000 account balance with a $3,000 daily loss limit cannot drop below $97,000 in one day.

Breaching this rule — even once — often means immediate disqualification.

3. Maximum Drawdown (Overall Loss Limit)

The maximum drawdown is the total amount your account can drop below the starting or peak balance before violating the trading rules.

Two main types:

-

Static Drawdown: Fixed limit (e.g., can’t go below $95,000).

-

Trailing Drawdown: Moves up as your profits increase (e.g., if your live funded account grows to $110,000, your limit may trail upward to $105,000).

This account rules ensures traders don’t give back too much profit or let losing streaks get out of control.

4. End-of-Day Drawdown

Some proprietary trading firms enforce a specific limit for how much your account balance can fall by the close of each day.

Even if you recover losses intraday, if your end-of-day balance is below the required threshold, it’s still a violation.

This teaches traders to close the day responsibly and avoid reckless overnight positions.

5. Minimum Trading Days

Prop firms want to ensure success isn’t due to one lucky trade. That’s why most require you to trade for a certain number of days, typically 5 to 10 during the evaluation phase.

This encourages consistency and provides a clearer picture of your overall trading style and performance.

6. Consistent Performance

Even if you hit the profit target, a successful funded trader must show consistent risk management and profit-taking behavior.

For example:

-

No single trade should make up most of your profit. This comes into play especially after you become a funded trader.

-

No massive drawdowns followed by sudden recoveries.

Consistency signals professionalism and emotional control. Two traits every funded trading program values.

7. Risk-to-Reward Discipline

Many funded trader programs monitor your risk-to-reward ratio. If you’re risking $1,000 per trade to make only $200, that’s unsustainable especially for day trading.

Ideal metrics:

-

Risk/Reward: 1:2 or better.

-

Win Rate: 40–60% is fine if risk/reward is solid.

This helps the firm confirm you have a solid trading approach, not one dependent on luck.

8. Adherence to Trading Rules

Each prop firm has its own specific rules that must be followed. These can include:

-

No trading during high-impact news events.

-

No holding trades overnight or over weekends.

-

No copy trading or automated bots unless allowed.

Breaking any of these funded account rules, even accidentally, can void your results.

9. Risk Management Practices

This is one of the most crucial evaluation criteria. Firms assess how well you manage your positions, lot sizes, and exposure across trades.

Strong risk management means:

-

Never risking more than 1–2% of your account on a single trade.

-

Avoiding over-leveraging when trading the financial markets.

-

Using stop-loss orders consistently.

Traders who show they can protect trading capital first are far more likely to get funded.

10. Emotional Control and Discipline

While not always a written requirement, it’s arguably the most important. Funded traders must demonstrate emotional stability:

-

No revenge trading after losses.

-

No impulsive position sizing.

-

No overtrading out of boredom or frustration.

Many firms evaluate your trading behavior. If they see erratic activity, they may flag your account even if you meet the numbers.

How the Evaluation Process Works

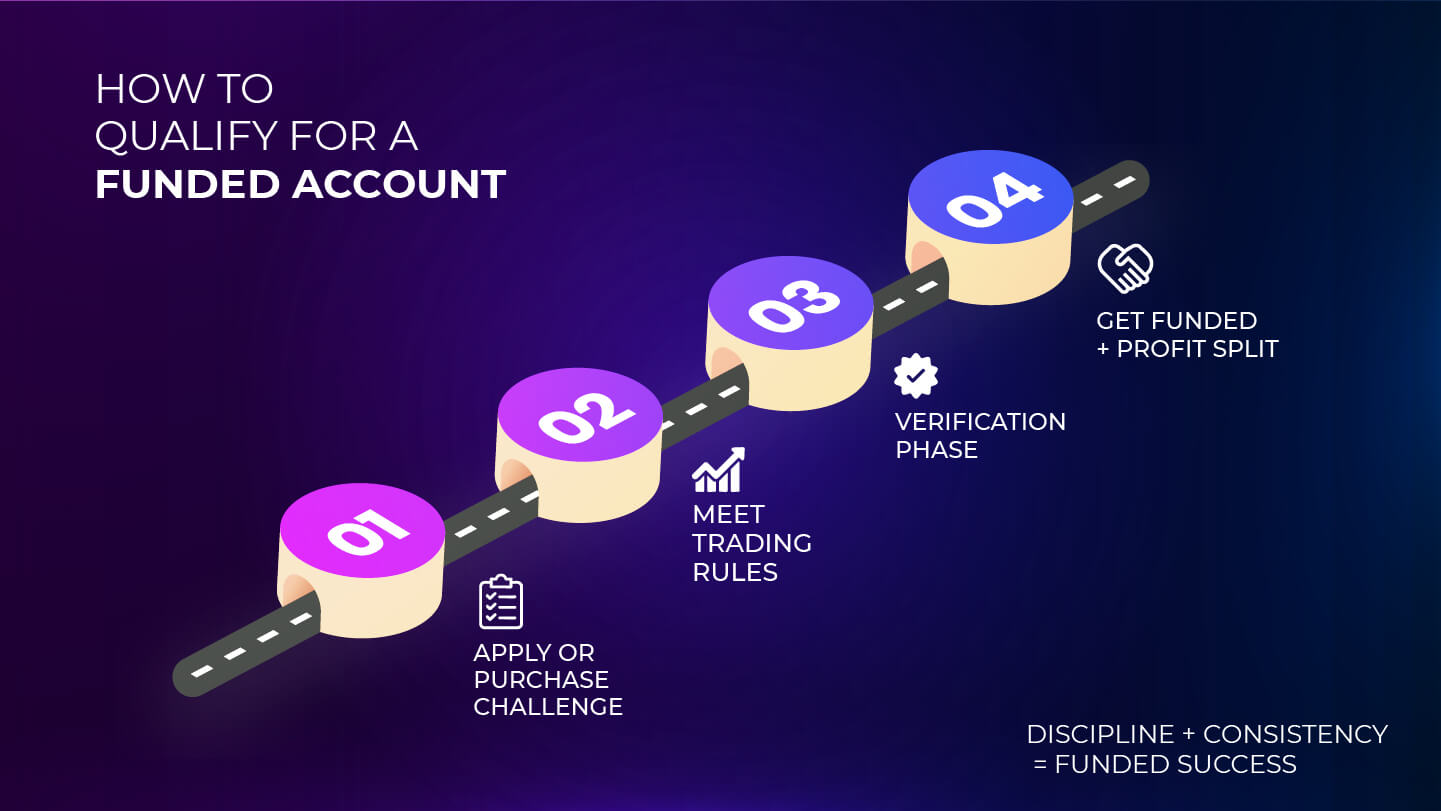

Step 1: Apply or Purchase a Challenge

You choose an account size that fits your trading style (e.g., $10,000, $50,000, $100,000) and pay a challenge fee to begin trading.

Step 2: Meet the Evaluation Rules

Trade according to the firm’s requirements: profit target, drawdown limits, and trading days.

Step 3: Verification Phase (Optional)

Some firms have a second verification stage to confirm your consistency over another period.

Step 4: Get Funded

Once you pass, you get a funded trading account and can trade real capital under similar rules.

Step 5: Withdraw Profits

The best prop firms usually allow profit withdrawals on a biweekly or monthly basis, with payouts ranging between 70%–90% of profits.

Tips to Qualify for a Funded Account Program

1. Prioritize Risk Management Over Profit

Focus on following your trading plan. If you avoid rule breaches, profits will come naturally over time.

2. Treat the Evaluation Like a Real Account

Don’t gamble because it’s a demo challenge. Prop firms want traders who behave professionally from day one.

3. Journal Every Trade

Track not only your results but your mindset. Most failures come from emotional lapses, not bad strategies.

4. Avoid Trading News Releases

Volatility during major news (like NFP or CPI) can cause unpredictable spreads that breach limits instantly.

5. Use Position Sizing Tools

Apps or calculators can ensure your risk per trade stays consistent.

6. Know the Firm’s Time Zone and Rules

Many traders fail by misunderstanding when the “trading day” resets or when the end-of-day balance is measured.

7. Stay Calm Under Pressure

If you hit a losing streak, reduce your position size or take a break. Consistency matters more than speed.

Common Reasons Traders Fail Evaluations

-

Over-Leveraging: Risking too much on one trade to hit targets faster.

-

Ignoring Rules: Forgetting small but critical rules like daily loss limits or trading time restrictions.

-

Lack of Patience: Trying to complete the challenge in a few days.

-

Emotional Overload: Allowing frustration or greed to cloud judgment.

-

No Adaptability: Using the same strategy in every market condition.

Remember, prop firms aren’t testing your ability to make one big trade. They’re testing whether you can survive and thrive under real-world trading conditions.

Frequently Asked Questions (FAQs)

1. What are typical funded trading account requirements?

They usually include hitting a profit target (8–10%), following loss limits, trading for a minimum number of days, and demonstrating consistency.

2. Do I need trading experience to qualify?

Basic trading experience helps, but many firms allow beginners to join. You’ll just need to pass an evaluation process first.

3. How much does it cost to join a prop firm?

Account challenges fees typically range from $100 to $1,000, depending on account size.

4. Can I fail even if I hit the profit target?

Yes, if you break rules like daily loss or drawdown limits, you’ll be disqualified even if your total profit is high.

5. What happens after I get funded?

You’ll trade a simulated account, follow similar rules, and receive a share of profits, usually between 70% and 90%.

Check if you meet 4Proptrader’s funded account requirements and start trading with our capital today.

Final Thoughts

Passing a prop firm challenge and qualifying for a funded trading account isn’t just about skill, it’s about discipline, emotional control, and consistency.

The funded trading account requirements exist not to limit you, but to prepare you for the reality of trading professionally. If you can respect risk, follow rules, and build steady profits without impulsive mistakes, you’re already ahead of most applicants.

Master the rules, stay patient, and trade strategically and soon you could be trading with a funded account that lets your trading skills shine.