Quick Summary

An end-of-day drawdown is a rule used by prop firms to limit how much your trading account can decline by the close of each trading day. If your account balance falls below this level, you risk breaching your funded or evaluation account. It’s one of the most important rules in prop trading because it keeps traders disciplined and protects firm capital. In this guide, we’ll explain what end-of-day drawdown means, how it’s calculated, why it matters, and proven strategies to avoid violating it.

Introduction

When trading with a proprietary (prop) firm, your ability to keep a funded account active depends on how well you respect the rules. One rule that trips up many beginners is the end-of-day drawdown.

Unlike profit targets, which push you to aim higher, or daily loss limits, which stop you from losing too much in one day, the end-of-day drawdown is about where your account balance stands at the close of the day.

Understanding this rule is essential. Many talented traders fail not because their strategy is weak but because they didn’t properly manage their account around max drawdown limits.

What Is End of Day Drawdown?

The end-of-day drawdown (often abbreviated EOD drawdown) is the maximum loss allowed on your account starting balance by the end of the trading day. If your balance or equity falls below this threshold—even temporarily in some firms—you’ll breach the rule and risk losing your funded account.

It’s essentially a risk checkpoint at the close of trading each day.

Example

If you have a $50,000 future funded account with a maximum end-of-day drawdown of $48,000, your minimum account balance must always end the trading day above that amount. If you close the day at $47,800, you’ve breached the rule—even if you had good trades earlier.

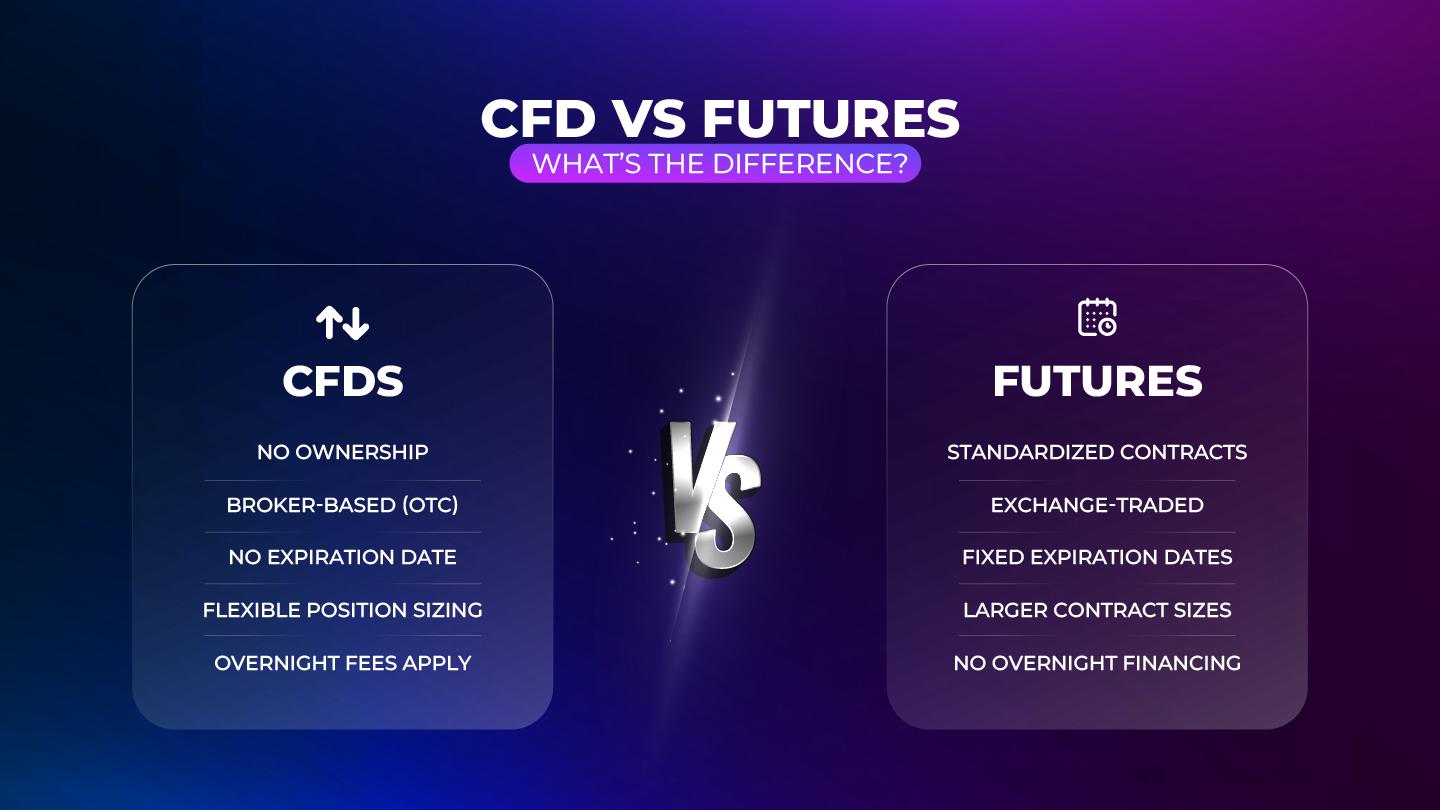

End of Day Drawdown vs. Daily Loss Limit

It’s easy to confuse end-of-day drawdown with a daily loss limit, but they’re different:

-

Daily Loss Limit: Caps the amount you can lose in one trading day, usually measured intraday. Breaching it at any point can disqualify you.

-

End of Day Drawdown: Measured at the end of the day, ensuring your account balance stays above a set threshold. You might be under during the day but must close above the rule by session end.

Both serve risk management purposes, but the end-of-day drawdown specifically enforces closing balance discipline.

Why Do Prop Firms Use End of Day Drawdown?

Prop firms introduce this rule for three main reasons:

-

Capital Protection

It prevents traders from letting accounts slide too far overnight or across sessions. -

Encouraging Consistency

EOD drawdown forces traders to manage an open position wisely and not leave risky positions unchecked. -

Professional Discipline

It mirrors institutional trading practices, where firms measure exposure at the daily close to manage overall risk.

How Is End of Day Drawdown Calculated?

Different prop firms calculate EOD drawdown in slightly different ways:

1. Fixed Drawdown

A set dollar amount is determined at the start of the account. Example: $50,000 account with a fixed drawdown of $2,000 = minimum balance of $48,000.

2. Trailing End of Day Drawdown

This moves up as your profits grow. For example, if your account grows to $52,000 and the trailing drawdown is $2,000, your new minimum becomes $50,000. This prevents traders from giving back all profits.

3. Equity vs. Balance

Some firms use equity (including open trades), while others use balance (closed trades only) to measure EOD drawdown. Equity-based rules are stricter since floating losses can trigger breaches even if trades recover later.

Common Mistakes Traders Make with End of Day Drawdown

-

Leaving Trades Overnight

Unmonitored positions can slip past limits if markets move unexpectedly. -

Misunderstanding Equity vs. Balance

Traders often assume only closed trades matter, but equity-based calculations count floating losses too. -

Failing to Track Closing Time

Not all firms define “end of day” the same way. Some use New York close, others use firm-specific cutoffs. -

Overleveraging Late in the Day

Chasing profits near the close can backfire and push the account below the limit.

Strategies to Avoid Breaching End of Day Drawdown

1. Know Your Firm’s Exact Rules

Does your firm measure equity or balance? What’s their defined end-of-day cutoff? Clarity prevents accidental breaches.

2. Keep a Buffer Zone

If your EOD limit is $48,000, set your personal minimum at $48,500 or higher. That extra cushion accounts for slippage and overnight spreads.

3. Flatten Positions Before the Close

Closing trades by the end of the session removes the risk of overnight volatility causing a breach.

4. Risk Less Near Market Close

Avoid high-risk trades in the final hour of the trading day. This is when mistakes can directly affect your closing balance.

5. Use Alerts and Tracking Tools

Most platforms let you set equity alerts. Automate reminders when you’re approaching your EOD threshold.

The Psychological Side of End of Day Drawdown

This rule can be mentally tough because it punishes traders for being sloppy late in the day. The stress of “making sure you’re safe before the close” can cause:

-

FOMO: Rushing into trades just before the session ends.

-

Revenge Trading: Trying to claw back losses quickly to stay above the limit.

-

Over-Caution: Closing good trades early out of fear of breaching.

The key is preparation—trade as if every session is a challenge to end safely above your threshold, not just to make profits.

Why End of Day Drawdown Matters for Funded Traders

For funded traders, breaching EOD drawdown is one of the top reasons accounts are lost. It doesn’t matter how good your strategy is—if you don’t respect the firm’s rules, you won’t keep your funding.

Mastering this rule demonstrates to the firm that you’re not just profitable but also reliable and disciplined, which is exactly what they’re looking for.

Frequently Asked Questions (FAQ)

1. What is end-of-day drawdown?

It’s the maximum loss your account can show by the close of the trading day. If your balance or equity ends below the set level, you breach your account.

2. Is end-of-day drawdown the same as a daily loss limit?

No. A daily loss limit applies intraday, while end-of-day drawdown checks your account only at the day’s close.

3. Can open trades cause me to breach end-of-day drawdown?

Yes—if your firm measures equity (open trades + balance). Even floating losses at the close may trigger a violation.

4. How do I avoid breaching end-of-day drawdown?

The best ways include closing positions before the session ends, setting a personal buffer above the limit, and avoiding oversized trades near the close.

5. Why do prop firms use this rule?

It helps firms manage risk, protect their capital, and encourage traders to maintain professional discipline.

Final Thoughts

The end-of-day drawdown is one of the most important guardrails in prop trading. It ensures traders stay disciplined, firms keep risk under control, and accounts last long enough to prove consistent profitability.

For traders, respecting this rule is non-negotiable. By understanding how it’s calculated, planning trades around the daily close, and keeping a buffer above the minimum, you can stay safe and keep your funded account alive.

In the end, surviving in prop trading isn’t just about making profits—it’s about protecting your account and proving consistency day after day.