Quick Summary

What is futures trading?

Futures trading involves buying or selling a futures contract that obligates you to trade an asset (like oil, gold, or stock indices) at a set price on a specific date in the future. It allows traders to speculate on price movements or hedge against market risks. Futures markets are known for their liquidity, leverage, and potential for both profit and loss — making them powerful but risky tools for beginners.

In this guide, we’ll break down what futures trading is, how it works, why traders use it, and how to manage the risks involved.

Introduction

If you’ve ever heard traders talk about “futures” but weren’t quite sure what they meant, you’re not alone. Futures trading is one of the oldest and most widely used types of commodity trading in the financial world.

While it might sound intimidating, the basics of futures trading are simple: you’re agreeing today to buy or sell something in the future at a price set today. These futures trade contracts can be based on commodities (like crude oil futures or wheat), stock indices, interest rates, or even cryptocurrencies.

For beginners, learning what futures trading is opens a world of opportunity — but it also requires understanding how leverage, margin requirement, and risk management work.

What Is Futures Trading?

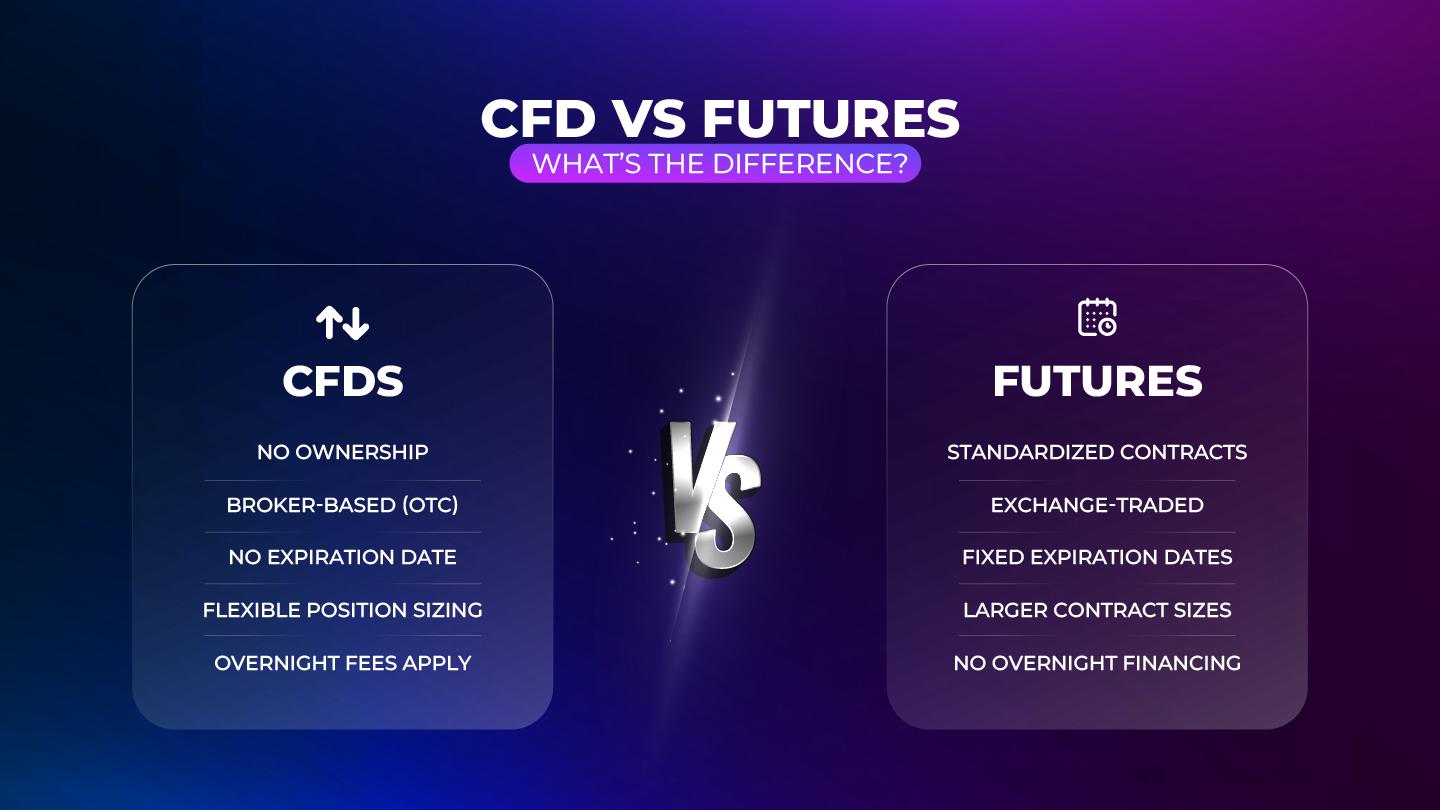

Futures trading is the buying and selling of futures contracts, which are standardized agreements to exchange an asset at a predetermined price and date in the future.

Unlike stocks, where you buy ownership in a company, a futures contract is an obligation — not an option — to buy or sell the underlying asset.

Example:

Let’s say crude oil is trading at $80 per barrel. You believe the price of the underlying asset will rise, so you buy a futures contract for 1,000 barrels at $80 (total value $80,000).

-

If oil rises to $85, you can sell the contract value for a $5,000 profit.

-

If oil falls to $75, you lose $5,000.

No physical barrels change hands; you’re simply speculating on market value price changes.

How Does Futures Trading Work?

1. Futures Contracts Are Standardized

Each contract size has:

-

A specific asset (like gold futures, S&P 500, or corn)

-

A contract size (how much of the asset it covers)

-

A settlement date (when it is set to expire)

Because contracts are standardized, they’re traded on regulated exchanges like the Chicago Mercantile Exchange (CME) or Intercontinental Exchange (ICE).

2. Margin and Leverage

Futures trading uses margin, meaning you don’t have to pay the full contract value upfront. Instead, you deposit a margin requirement — usually 3–10% of the total futures account value.

For example, with a $100,000 contract and a 5% futures margin, you only need $5,000 to control that position. This leverage can amplify both profits and losses.

3. Mark-to-Market Adjustments

Futures accounts are marked to market daily, meaning your profits or losses are settled at the end of each day. If your equity drops below the initial margin, you’ll receive a margin call and must deposit more funds or close positions.

4. Expiration and Settlement

All futures and options contracts have an expiration date. When that date arrives, the contract either:

-

Physically settles (actual delivery of the asset), or

-

Cash settles (the difference between the contract price and the market price is paid).

Most futures traders’ close positions before expiry to avoid delivery.

Why Do Traders Trade Futures?

1. Speculation

Futures exchange allow traders to profit from price movements in both directions.

-

Go long if you think the value of the futures contract price will rise.

-

Go short (sell a futures contract) if you think price of a futures contract will fall.

Because of leverage, even small moves financial futures can generate big gains (or losses). Thus, it’s important to note that trading involves substantial risk.

2. Hedging

Producers, consumers, and investors use futures to hedge against market price risk.

-

A farmer might sell wheat futures to lock in a selling price.

-

An airline might buy oil futures to fix fuel costs.

Hedging reduces uncertainty in volatile markets.

3. Diversification

Futures cover a wide range of markets — from commodities to stock indices and financial instrument currencies — allowing traders to diversify beyond traditional investments like stocks or bonds.

Popular Futures Markets

Some of the most traded futures contracts include:

-

Stock Index Futures: S&P 500, NASDAQ, Dow Jones

-

Commodity Futures: Gold, crude oil, natural gas, corn, coffee

-

Currency Futures: EUR/USD, GBP/USD, JPY/USD

-

Interest Rate Futures: U.S. Treasury Bonds, Eurodollar

-

Crypto Futures: Bitcoin and Ethereum (on select exchanges)

Advantages of Futures Trading

- High Liquidity: Futures markets are among the most liquid globally, with millions of contracts traded daily.

- Leverage: Small margin deposits control large contract values.

- Profit from Any Direction: You can go long or short with equal ease.

- Transparency: Regulated exchanges ensure standardized, fair pricing.

- Diversification: Access to multiple asset classes from one platform.

Risks of Futures Trading

- High Leverage Risk: While leverage amplifies profits, it can also lead to rapid, large losses.

- Margin Calls: Losing trades can trigger margin calls, forcing traders to deposit more funds into their futures trading account.

- Volatility: Futures markets move fast — one wrong position can wipe out an account in a trading session.

- Complexity: Options and Futures require understanding of contract specifications, margin requirements, and expiry dates.

- Emotional Stress: The speed and leverage in futures trading can trigger impulsive trading activity if you’re not disciplined.

Strategies for Beginners

1. Start Small and Trade Micro Contracts

Many exchanges offer micro futures (1/10th the size of standard contracts). They’re ideal for beginners to learn with less risk.

2. Use Stop Loss Orders

Always define your exit point before entering a trade. A stop loss limits how much you can lose on a single position.

3. Focus on One Market

Stick to one market (like s&p 500 futures or crude oil) until you understand how it moves.

4. Keep a Trading Journal

Track your trades every trading day, emotions, and mistakes to refine your strategy.

5. Avoid Over-Leveraging

Using all available margin increases risk. Trade smaller sizes to survive market swings within a trading day.

6. Stay Updated on News

Economic events (interest rate decisions, inventory reports, geopolitical events) can move the stock market dramatically.

Frequently Asked Questions (FAQs)

1. What is futures trading in simple terms?

It’s a way to speculate on the future price of an asset using standardized contracts traded on exchanges.

2. How is futures trading different from stock trading?

Stock trading involves owning shares; futures trading is based on contracts. Futures contracts also use leverage, which means you can control large positions with smaller capital.

3. Can beginners trade futures?

Yes — but start with micro contracts and focus on learning risk management first. Futures can be profitable, but the learning curve is steep.

4. What’s the minimum to start futures trading?

Many brokers allow micro futures accounts with as little as $1,000–$2,500 in margin, depending on the contract.

5. Is futures trading risky?

Yes. Futures are leveraged instruments, meaning both profits and losses are magnified. Always use stop losses and never risk money you can’t afford to lose.

How to Start Trading Futures Safely

Understanding what futures trading is, how it works, and how to manage risk is the first step.

The next step is to apply your knowledge in a real trading environment but without putting your own capital at risk.

With 4Proptrader (https://4proptrader.com/ ), you can prove your skills through an evaluation, get funded, and start trading futures with real capital provided by professionals.

It’s the safest way to gain hands-on experience while building the discipline and confidence every successful trader needs.

Final Thoughts

So, what is futures trading? It’s the buying and selling of contracts that let you speculate on or hedge against future price movements of assets like commodities, currencies, and indices.

Futures offer incredible flexibility and opportunity, but they demand respect — especially for leverage and risk. For beginners, the key is to start small, focus on education, and trade strategically rather than emotionally.

Mastering futures trading takes time, but with patience, discipline, and a focus on risk management, it can become a valuable part of a trader’s toolkit.