If you’re new to the world of funded trading programs, you’ve probably come across the term “profit share plan.” But what is a profit-sharing plan, and how does it work in the trading industry?

In this guide, we’ll break down exactly what a profit share plan is, how it applies to funded traders, and why it’s a key part of trading with a prop firm or trading program. Whether you’re considering joining a funding program or just curious about the concept, this blog post will give you the clarity you need.

Quick Summary:

What is a profit share plan?

A profit share plan is an agreement between a trader and a proprietary trading firm that outlines how trading profits are split. As a funded trader, you trade the firm’s capital and keep a portion of the profits—typically 70% to 90%—while the firm keeps the rest.

Why does this matter?

Profit share plans give aspiring traders access to large accounts without risking their own money. You trade, generate profits, and share the earnings. It’s a win-win: the trader gets paid for their skills, and the firm earns a share of the profits in return for providing the capital.

Bottom line:

If you’re looking to trade professionally without using your own funds, a profit share plan is a practical way to get started—just make sure you understand the terms, rules, and profit split before jumping in.

What Is a Profit Share Plan?

Let’s start with the basics.

A profit share plan document is an agreement between a trader and a proprietary trading firm (prop firm/employer) or trader funding program that outlines how trading profits will be split. It’s essentially a revenue-sharing model.

When you trade with a funded account, the capital you’re trading isn’t yours—it belongs to the firm. However, when you generate profits, you get to keep a portion of those profits as your share of the earnings. The rest goes to the firm, since they’re providing the funding and taking on the financial risk.

A Simple Example:

Imagine you pass a funded trading program’s evaluation, and you’re given access to a $100,000 trading account. After your first month of trading, you generate $10,000 in profits.

If your profit share plan is 80/20, here’s how the split would work:

- You keep 80% of the profits: $8,000

- The firm keeps 20% of the profits: $2,000

This arrangement allows you to trade with serious capital while reducing the personal financial risks you’d face if you were trading your own funds.

Why Do Prop Firms Use Profit Share Plans?

Funded trader programs exist to give talented traders access to large trading accounts without requiring them to risk their own money. But since the firm is taking on the risk, they need to be compensated for providing the capital.

That’s where profit share plans come in. They create a win-win scenario:

- The trader gets access to large capital and earns money by sharing in the profits.

- The firm earns a portion of the profits in exchange for providing the funds and infrastructure.

Typical Profit Share Percentages

Different firms offer different profit splits. The exact percentage can depend on the company, the type of trading program, and the trader’s performance. Here are some common examples:

| Profit Share Plan | Who Gets What? |

|---|---|

| 80/20 Split | Trader keeps 80%, firm keeps 20% |

| 70/30 Split | Trader keeps 70%, firm keeps 30% |

| 90/10 Split | Trader keeps 90%, firm keeps 10% (usually for top-performing traders) |

| 50/50 Split | Trader and firm split profits evenly (less common for skilled traders) |

Most modern prop firms lean toward 70/30 or 80/20 splits, as these ratios attract more traders while keeping the firm’s business model sustainable.

How Does a Profit Share Plan Work in Practice?

Here’s a step-by-step look at how a profit share plan works for a funded trader:

1. Complete an Evaluation

Most firms require traders to pass an evaluation phase before they gain access to a funded account. This might involve:

- Hitting specific profit targets

- Following risk management rules

- Staying within drawdown limits

2. Get Funded

Once you pass the evaluation, the firm provides you with a funded trading account. This could be $10,000, $50,000, $100,000, or even more, depending on the program.

3. Trade the Firm’s Capital

You start trading using the firm’s capital, following any guidelines they’ve set—such as maximum drawdown rules or position size limits.

4. Generate Profits

If you make profitable trades, those earnings are considered gross profits. However, since the money belongs to the firm, the profits are split according to the agreed profit share plan.

5. Withdraw Your Share

At the end of the payout period (varies from weekly, bi-weekly, or monthly), you can request your profit withdrawal. Some firms have specific payout dates or minimum thresholds for withdrawals.

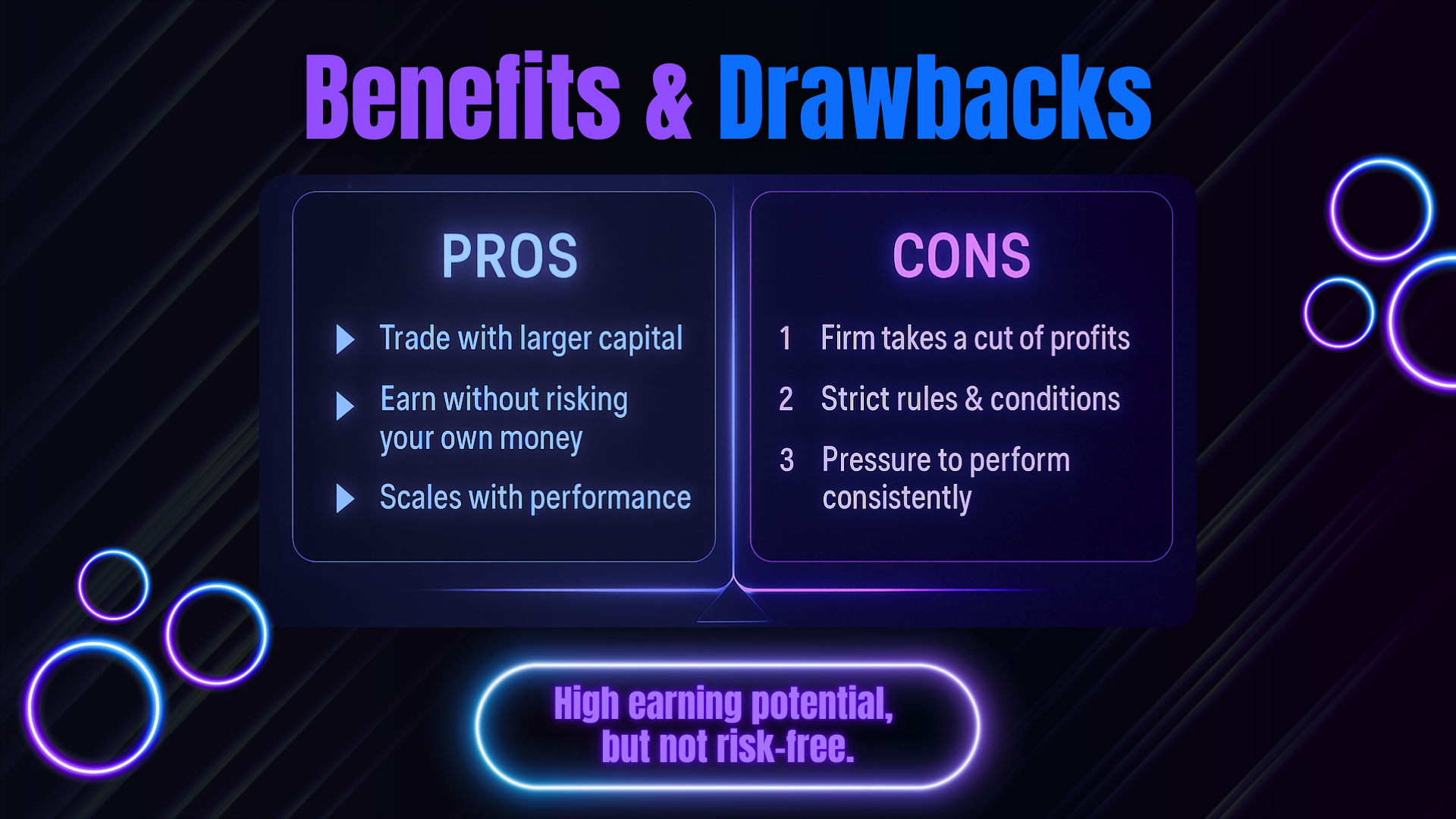

Benefits of a Profit Share Plan for Aspiring Traders

If you’re an aspiring funded trader, a profit share plan offers several advantages:

1. Trade Larger Accounts

Most individual traders don’t have access to $50,000, $100,000, or more in capital. A profit share plan lets you trade big accounts without risking your own retirement savings.

2. Minimize Personal Risk

Since the trading account is funded by the firm, your personal financial risk is limited to the program fee or evaluation cost. You’re not risking your own trading capital.

3. Earn Consistent Income (If Profitable)

With a fair profit share plan, you can generate real income from your trading skills. If you’re consistent, this can become a significant revenue stream which can increase your annual profits.

4. Focus on Performance, Not Funding

Many traders spend years trying to build up their own trading capital. A profit share plan allows you to skip that step and focus purely on trading performance.

Are There Any Downsides?

While profit share plans offer clear benefits, there are also potential drawbacks to consider:

1. You Don’t Keep 100% of the Profits

Since you’re trading someone else’s money, you’ll always share a portion of your earnings. Some traders find this frustrating, especially if they’re generating large profits.

2. Trading Rules Apply

Most funded trading programs have strict rules around risk management. Violating these rules—like breaching a maximum drawdown—can result in losing your funded account.

3. Evaluation Costs

Many firms charge a fee to enter the evaluation phase, which is essentially the price of getting the chance to trade funded capital. While this isn’t part of the profit share, it’s an upfront cost to be aware of.

How to Choose the Right Profit Share Plan

Not all profit share plans are created equal. Here’s what to look for when selecting a funded trading program:

1. Profit Split Ratio

Consider how much of the profits you’ll keep. An 80/20 split is more favorable to the trader than a 50/50 split.

2. Payout Frequency

Some programs pay monthly, while others offer bi-weekly or even weekly payouts. Faster payouts may suit traders who rely on consistent cash flow.

3. Scaling Opportunities

Some firms allow you to scale up your account size if you trade successfully. For example, if you perform well over several months, your trading capital and potential profits could increase. This can prove beneficial toward your retirement plan as you can have the freedom to retire early and live life on your own terms perhaps even start a side-hustle small business apart from trading.

4. Support and Tools

Look for firms that offer strong support, educational resources, and trading tools. This makes your trading experience smoother and more efficient.

5. Transparency

Work with firms that are transparent about fees, rules, and profit splits. Avoid any company that’s vague or misleading about how their profit share plans work.

Final Thoughts: Is a Profit Share Plan Right for You?

So, what is a profit share plan? It’s a partnership between you—the trader—and the firm providing the capital. You trade using their funds, and when you make a profit, you keep a set percentage while the firm keeps the rest.

For aspiring funded traders, profit share plans are a practical way to build a trading career without needing massive personal capital. They give you the chance to earn real profits, gain trading experience, and minimize financial risk.

Before you get started, make sure you understand the terms of the profit share plan, know the rules of the program, and are ready to trade with discipline. If you can do that, a profit share plan could be the stepping stone you need to succeed in the world of funded trading.