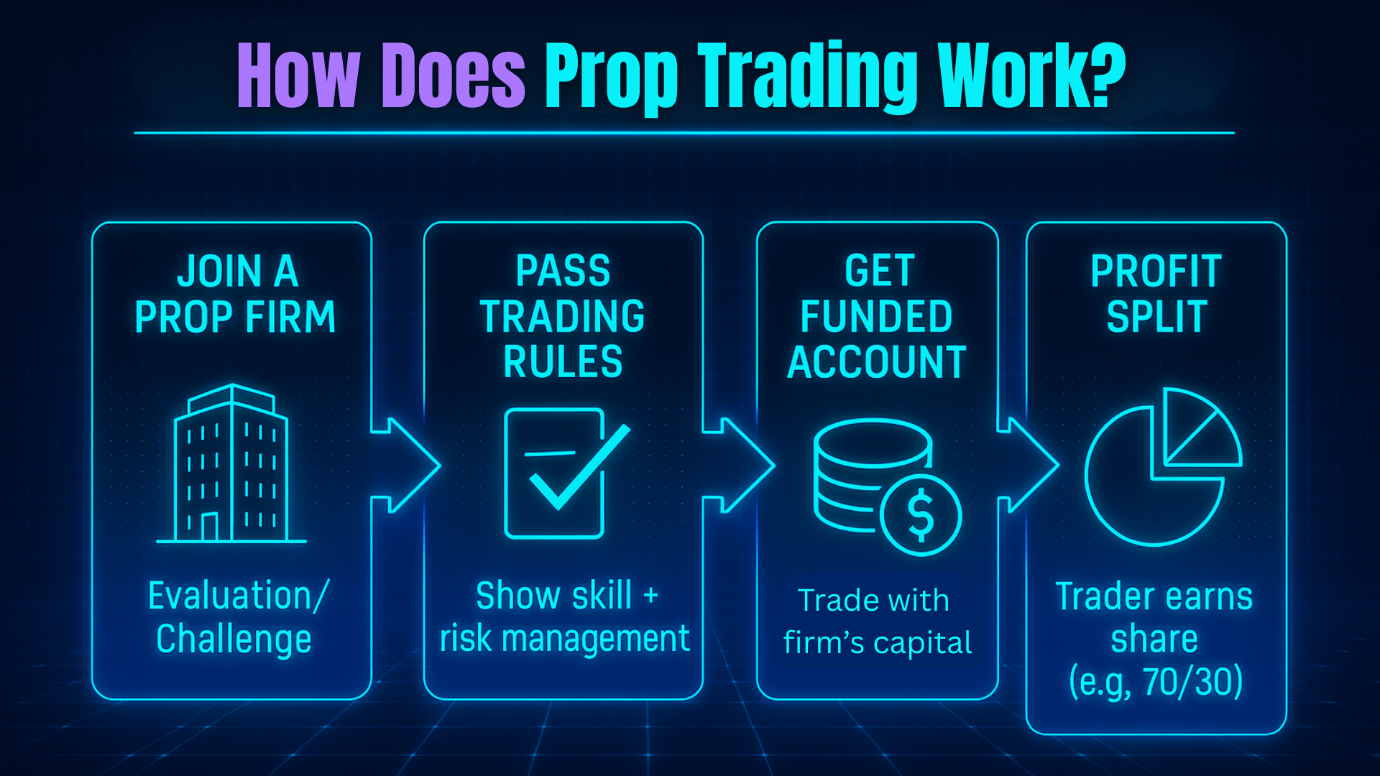

Proprietary trading, or prop trading, is when a trader uses a firm’s capital to place trades—rather than their own money. The firm backs the trader financially, and in return, both parties share in the profits.

The word "proprietary" means owned by the firm. So, when you engage in prop trading, you’re trading the firm’s proprietary capital, not your personal funds.

Quick Summary

What is prop trading?

Prop trading (short for proprietary trading) is when traders use a firm's capital to place trades, rather than their own money. In return, profits are shared between the trader and the firm—usually with the trader keeping 70–90%.

Prop firms evaluate traders through demo challenges or live assessments, and successful candidates receive access to a funded trading account. Prop traders typically trade forex, indices, crypto, or stocks, depending on the firm.

Why it matters:

Prop trading offers skilled traders the chance to earn real money without risking their own funds. It’s ideal for traders who are confident in their strategy but lack capital.

Bottom line:

If you’re disciplined, consistent, and ready to trade within clear risk guidelines, prop trading can be a fast track to serious capital and real profit potential.

Why Do Prop Firms Offer This?

Prop trading firms are in business to make money. By recruiting and funding skilled traders, they can scale their profits across many accounts, markets, and strategies. Their model works because:

-

They reduce their own risk by controlling how traders operate.

-

They earn a percentage of the profits their traders generate.

-

They use strict rules and risk controls to manage downside exposure.

The more successful their traders are, the more money the firm makes. It’s a performance-based model that works for both sides.

How Does Prop Trading Work?

Here’s a breakdown of the typical prop trading model:

1. Application or Evaluation Phase

Most prop firms require traders to prove they’re skilled before giving them real capital. This often involves a demo challenge or evaluation period where you must:

-

Reach a profit target (e.g., 8–10%)

-

Follow risk management rules (like max drawdown limits)

-

Trade within a set time frame (e.g., 30 trading days)

If you pass, you move on to the next phase.

2. Funding and Live Account

Once approved, you’re given access to a funded account—usually ranging from $10,000 to $500,000+, depending on the firm. You trade this capital according to the firm’s rules.

3. Profit Split Plan

Prop trading firms don’t give away free money. They typically offer a profit-sharing model, where you keep a percentage of the profits (often 70% to 90%) and the firm keeps the rest.

Example:

-

You generate $5,000 in profits

-

Your profit split is 80/20

-

You keep $4,000, the firm keeps $1,000

4. Scaling Plans and Bonuses

Many firms offer scaling plans, meaning if you trade successfully and consistently, they’ll increase your capital allocation. Some firms also offer performance bonuses or higher profit splits over time.

Types of Prop Trading Firms

Not all prop firms operate the same way. Here are the main types:

1. Traditional Prop Firms

-

Usually require you to work on-site (especially in major financial cities)

-

Focus on financial instruments like stocks, futures, and options

-

Offer full-time roles, sometimes with a base salary or stipend

-

Example: Jane Street, Optiver, DRW

2. Remote Retail-Focused Prop Firms

-

Cater to retail traders worldwide

-

Operate online with fully remote access

-

Specialize in forex, indices, crypto, and commodities

-

Use a challenge model to evaluate traders

-

Example: FTMO, MyForexFunds (now defunct), The Funded Trader, TopStep

Prop Trading vs. Trading Your Own Money

| Feature | Prop Trading | Self-Funded Trading |

|---|---|---|

| Capital | Provided by firm | Your own money traded via a broker |

| Risk | Firm takes the loss | You absorb full loss |

| Profit Share | You keep a portion | You keep 100% |

| Rules | Must follow firm’s guidelines. For instance, most prop firms don’t allow traders to hedge trades. |

You set your own |

| Upside | Access to large capital quickly | Growth limited by personal funds |

If you're confident in your skills but lack capital—or want to trade without risking your own money—prop trading may be the better path.

What Can You Trade with a Prop Firm?

Prop firms typically allow you to trade:

-

Forex (currency pairs)

-

Indices (S&P 500, DAX, NASDAQ, etc.)

-

Commodities (gold, oil)

-

Crypto (BTC, ETH, etc.)

-

Stocks and options (primarily with traditional prop firms)

The exact instruments vary by firm, so check what’s allowed before joining.

Pros of Prop Trading

✅ Low Financial Risk

You’re not risking your own capital, aside from the cost of the evaluation (if any).

✅ Access to Big Capital

You can trade large accounts and earn meaningful profits—even if you start with limited personal funds.

✅ Structured Environment

Rules around drawdown, leverage, and position sizing help instill good trading habits.

✅ Potential for Fast Growth

If you perform well, many firms will increase your capital allocation.

Cons of Prop Trading

❌ Strict Rules

Most prop firms enforce strict guidelines on risk per trade, daily loss limits, high-frequency trading, and more. Violating them can get your account revoked.

❌ Evaluation Fees

Some firms charge a fee to enter their evaluation program. If you fail, you may have to pay again.

❌ You Don’t Keep All Profits

Unlike trading your own capital, you only keep a portion of the profits.

❌ No Guarantees

Passing an evaluation doesn’t guarantee consistent income—it still depends on your trading performance.

Risks and Criticisms of Prop Trading

While the idea of trading with someone else’s money sounds like a dream come true, prop trading isn’t without serious risks and criticisms. Many traders jump in expecting easy profits, only to be blindsided by strict rules, shady practices, and emotional pressure that can derail even the most promising start.

Here’s what you need to know before you commit.

1. Evaluation Burnout and Failure Fatigue

Most modern prop firms use a challenge-based evaluation system where you must prove your trading skill over a defined period—often with profit targets of 8–10% and strict daily drawdown rules.

This sounds fair until you realize:

-

One bad trade can disqualify you, even if your overall strategy is sound

-

Psychological pressure mounts quickly when you’re on the clock

-

Many traders fail multiple evaluations, racking up hundreds in fees without ever getting funded

Example: A trader pays $199 to join a $100K challenge with a 10% profit target and 5% daily drawdown limit. He makes 9% over 25 days—but one sharp reversal causes a 5.2% intraday loss. Account disqualified. No refund. Start over.

This cycle can be mentally draining, especially if traders don’t take time to review and adapt between attempts.

2. Scammy or Unsustainable Firms

Not all prop firms are created equal. In recent years, some firms have popped up with flashy marketing and unrealistic promises—but behind the scenes, they’re operating shady models.

Red flags to watch for:

-

Vague or shifting rules during the challenge phase

-

No clear information about the company’s team or location

-

Poor or delayed payouts

-

No transparency on whether accounts are live or simulated

-

Overly aggressive marketing claiming “instant wealth”

One notorious example: MyForexFunds, once a major player in retail prop trading, faced regulatory action in 2023 and collapsed, leaving many traders unpaid. It served as a wake-up call for the entire industry.

Tip: Before signing up, research the firm’s track record, legal status, and trader reviews across forums like Trustpilot, Reddit, or Forex Factory.

3. Emotional Pressure and Performance Anxiety

Prop trading adds a layer of emotional pressure that can magnify normal trading stress:

-

You’re trading someone else’s money

-

You’re being evaluated and watched (even if it’s algorithmic oversight)

-

Mistakes feel more costly, even if the money isn’t technically yours

This can lead to:

-

Overtrading or revenge trading to “catch up”

-

Avoiding trades out of fear of breaking rules

-

Deviating from your normal strategy under pressure

Even successful traders have blown funded accounts not due to bad strategy—but because they didn’t manage the mental game.

Final Thought on Risks

Prop trading can offer life-changing opportunities—but only if you approach it with clear eyes and steady discipline. Don’t get swept up in the hype. Know the rules, research the firm, and prepare mentally for the added pressure. That’s how smart traders turn prop capital into real profit—without burning out.

Is Prop Trading Legit?

Yes—prop trading is a legitimate path used by both institutional traders and retail traders worldwide. However, like any industry, not all firms are created equal. Look for:

-

Regulated or transparent companies

-

Fair rules and payout terms

-

Good reviews from verified traders

Avoid firms that are vague, promise unrealistic earnings, or don’t clearly outline their risk and funding models.

How to Get Started with Prop Trading

If you’re ready to try prop trading, here’s a step-by-step guide:

-

Choose a Reputable Firm

Look for a firm that matches your trading style (e.g., forex vs. equities) and offers reasonable rules. -

Start an Evaluation or Challenge

Follow the rules, hit the targets, and don’t overtrade. -

Get Funded

If you pass, you’ll receive a live funded account to trade with. -

Trade Smart, Not Fast

Stick to your plan. Protect your account. Prioritize consistency over big wins. -

Withdraw Profits and Scale Up

Once you’ve proven yourself, scale up and explore long-term earning potential.

Final Thoughts

So, what is prop trading? It’s an opportunity for skilled traders to access large capital and earn profits without risking their own money. While it comes with rules and pressure to perform, it also opens doors for serious traders to grow quickly in the financial markets.

If you’ve got the discipline, strategy, and mindset to succeed, prop trading could be your entry point to a professional trading career—no Wall Street degree required.

Frequently Asked Questions (FAQ)

Is prop trading profitable?

Yes, prop trading can be highly profitable, but it depends entirely on the trader’s skill, discipline, and consistency. Since you’re using the firm’s capital, the potential to earn significant returns exists even with modest percentage gains. However, profitability isn't guaranteed—many traders fail evaluations or struggle under the rules and emotional pressure. Success requires a strong strategy, proper risk management, and mental resilience.

Do prop traders get a salary?

In most retail prop firms, traders do not receive a fixed salary. They are compensated through a profit split model, meaning they only earn when they generate profits for the firm. Some traditional institutional prop firms or a hedge fund for instance may offer salaried roles with performance bonuses, but these are typically in-office positions and often require finance degrees or formal trading experience.

How much can you make in prop trading?

There’s no fixed limit. Your earnings depend on:

-

The size of your funded account

-

Your profitability as a trader

-

The firm’s profit split (usually 70%–90%)

For example, if you're trading a $100,000 account with an 80/20 profit split and you earn 10% in a month, you'd take home $8,000. That said, returns can fluctuate, and many traders make far less (or nothing at all) depending on performance and risk.